Red Sea Disruptions Continue: How Ongoing Instability Is Reshaping Global Shipping Routes and Rates in 2026

Over two years after the first Houthi missile struck a commercial vessel in the Red Sea, the global shipping industry is still navigating one of the most consequential trade disruptions in modern history. What started as a regional conflict spillover has permanently altered how carriers, shippers, and logistics providers think about ocean freight routing, risk, and resilience.

The Crisis That Won't End

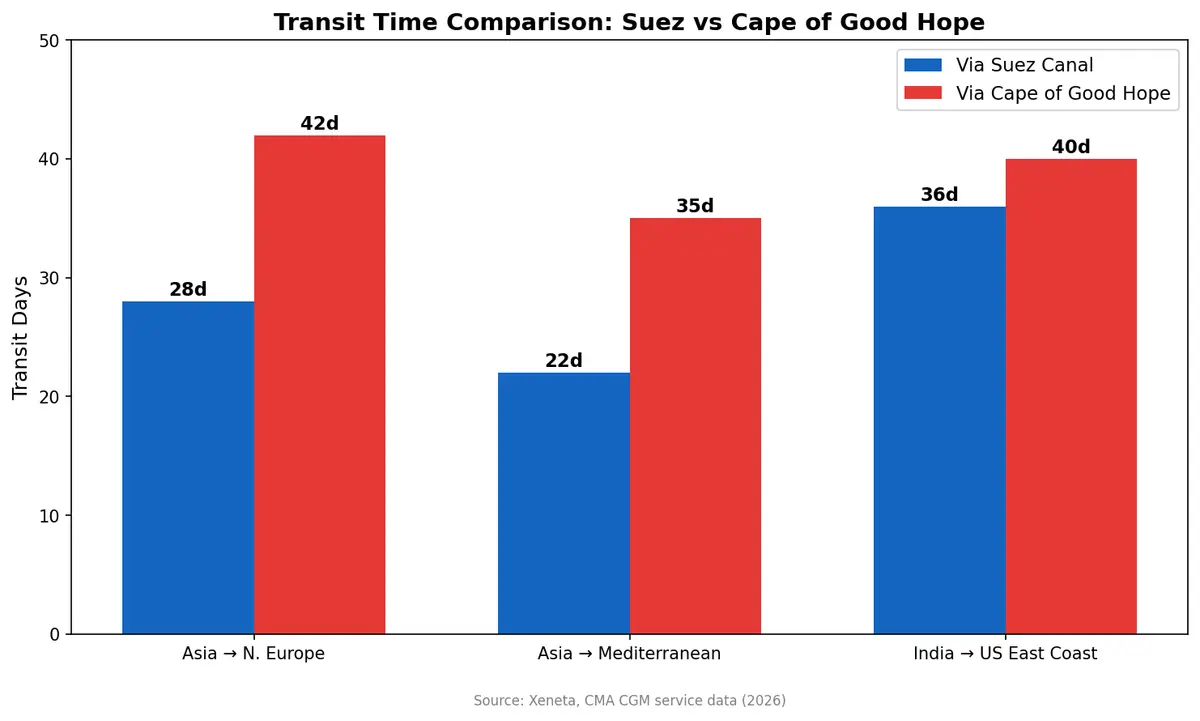

The Red Sea crisis began in November 2023 when Houthi forces seized the Galaxy Leader and launched a wave of attacks targeting more than 100 merchant vessels transiting the Bab el-Mandeb Strait. The violence slashed Red Sea traffic by roughly 60%, forcing carriers to reroute around the Cape of Good Hope — adding 10 to 14 extra sailing days and upending schedules across every major East-West trade lane.

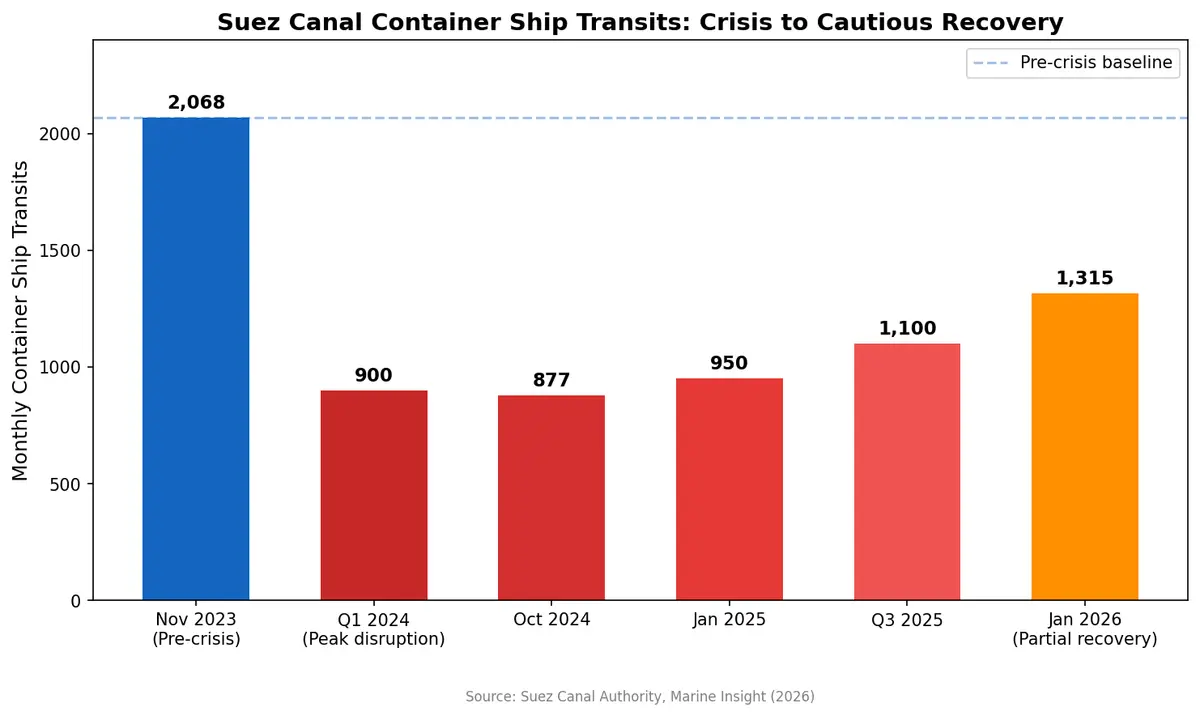

Despite a Gaza ceasefire in late 2025 that temporarily paused attacks, the situation in February 2026 remains deeply uncertain. The Suez Canal Authority reported 1,315 ships transited between January 1 and February 8, 2026 — an improvement over 2025's lows, but still far below the pre-crisis baseline of over 2,000 monthly transits.

The CMA CGM Reversal: A Reality Check

The fragility of any perceived recovery was laid bare in January 2026 when CMA CGM — the carrier most aggressive about resuming Suez transits — abruptly reversed course. Just days after sending the 23,000-TEU CMA CGM Jacques Saade through the canal (the largest vessel to do so in two years), the French carrier rerouted its FAL1, FAL3, and MEX services back around the Cape, citing a "complex and uncertain international context."

Transit times on CMA CGM's FAL1 service had improved from 105 days to 98 days after resuming Suez transits. Those gains were immediately lost, disrupting inventory planning for shippers who had paid premiums for faster delivery.

"Shippers crave predictability in supply chains," noted Xeneta Senior Market Analyst Destine Ozuygur. "Many shippers would rather accept longer, consistent transit times around the Cape than face sudden schedule changes."

The Staggering Cost of Rerouting

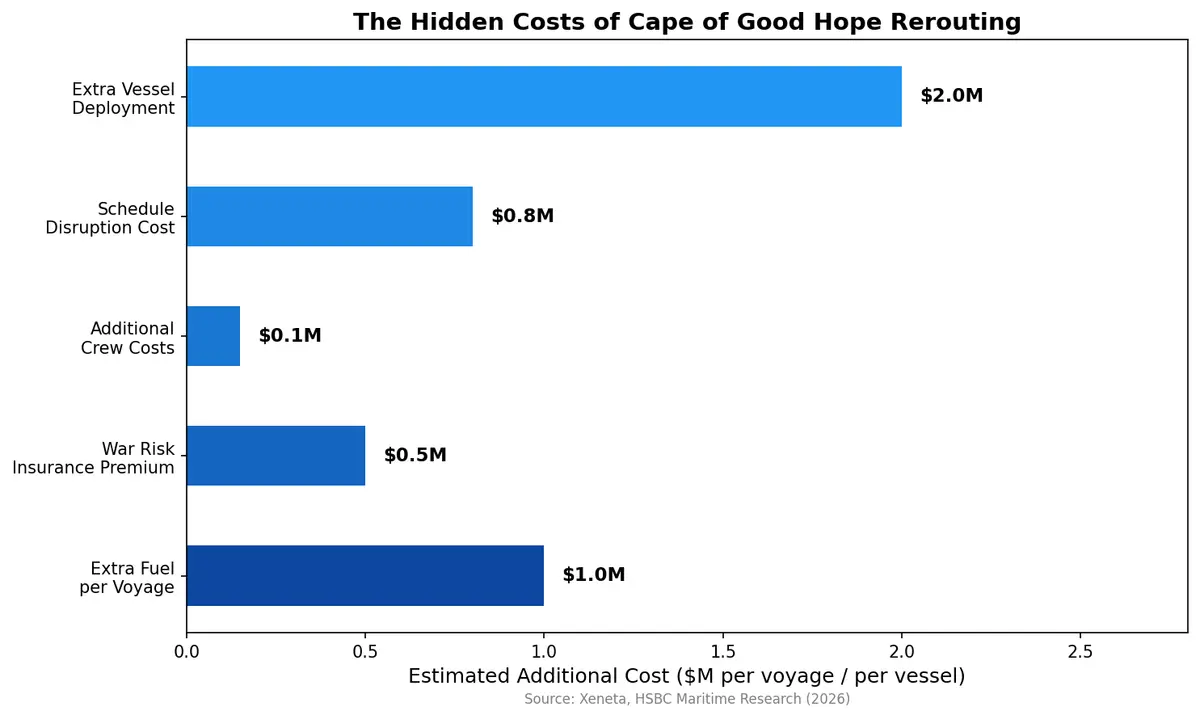

Cape of Good Hope diversions continue to tie up roughly 2 million TEUs of effective global capacity — an estimated 8% reduction in available supply. For individual voyages, the financial impact is severe.

Each diverted Asia-to-Europe voyage burns approximately $1 million in additional fuel alone. War risk insurance premiums, which spiked from 0.07% to over 1% of hull value during peak disruption, remain elevated. Carriers have deployed additional vessels to maintain weekly service frequencies on longer routes — tying up capacity that would otherwise pressure rates downward.

The ripple effects extend far beyond carrier economics. Egypt's Suez Canal revenues, which peaked at $10 billion in 2023, suffered an estimated 40% decline according to UNCTAD. East African nations saw European trade volumes drop as cargo bypassed the canal. Southern African ports, meanwhile, experienced surges in vessel calls but lacked the infrastructure to capitalize — South African ports were hobbled by systemic challenges, while West African ports faced congestion and cargo handling delays.

Transit Times: The New Math

For logistics planners, the crisis has rewritten fundamental assumptions about ocean freight scheduling.

The extra 10-14 days per voyage on Asia-Europe lanes has cascading effects: larger safety stock requirements, longer cash-to-cash cycles, increased warehousing costs, and more complex demand planning. For time-sensitive cargo like fashion, electronics, and perishables, the extended transit windows have forced difficult decisions about modal shifts, inventory strategies, and nearshoring.

What's Happening Now: A Cautious, Uneven Recovery

As of February 2026, the picture is one of cautious, fragmented recovery:

- Maersk has confirmed its Middle East-India-U.S. East Coast (MECL) service will permanently return to the trans-Suez route following successful trial voyages

- CMA CGM pulled back from Suez after initially leading the return, though its INDAMEX India-U.S. service remains on the canal route

- Most carriers continue routing around the Cape for Asia-Europe services, waiting for sustained security before committing to full returns

- Spot rates on Far East-Europe and Far East-U.S. East Coast lanes are down more than 50% from early 2025 peaks, with Xeneta warning rates could fall 25% further if a full Suez return releases pent-up capacity

HSBC analyst Parash Jain estimates that prolonged disruptions lasting until mid-2026 would limit freight rate declines to 9-16%, while a rapid normalization could trigger much steeper drops — a paradox where continued instability actually supports carrier profitability.

How Shippers Are Adapting

Smart shippers aren't waiting for geopolitical resolution. They're building structural resilience:

Dual-route planning. Leading companies now model both Suez and Cape scenarios simultaneously, maintaining flexibility to shift procurement and inventory strategies within days of routing changes.

Inventory buffer strategies. Companies are increasing safety stock by 15-25% for goods sourced via affected lanes, accepting higher carrying costs as insurance against transit time volatility.

Nearshoring acceleration. The disruption has reinforced the case for diversifying production closer to end markets. Mexico, Turkey, and Eastern Europe continue gaining share as alternative sourcing destinations.

Contract flexibility. Annual ocean freight contracts increasingly include clauses for routing-dependent pricing — one rate for Suez, another for Cape — allowing both carriers and shippers to share the risk.

The Role of Technology in Disruption Management

When routes can change overnight, real-time visibility and dynamic route optimization aren't luxuries — they're operational necessities. Modern TMS platforms enable logistics teams to:

- Monitor vessel positions and routing changes in real time

- Model cost and transit time scenarios across alternative routes instantly

- Automate carrier selection based on current routing patterns

- Adjust inventory triggers and procurement schedules dynamically

CXTMS provides these capabilities through integrated ocean freight management, giving shippers the agility to respond to disruptions like the Red Sea crisis without manual fire-drills.

Looking Ahead: Preparing for Permanent Uncertainty

The Red Sea crisis has taught the industry a hard lesson: geopolitical disruptions don't resolve on convenient timelines. Even with a ceasefire, the threat of renewed attacks keeps carriers cautious and shippers exposed. The 12% of global seaborne trade that transits the Suez Canal remains hostage to regional instability that no logistics technology can fully mitigate.

What technology can do is compress decision cycles, improve scenario planning, and give supply chain leaders the data they need to act decisively when — not if — the next disruption hits.

Navigating ocean freight disruptions? Contact CXTMS for a demo of our real-time route optimization and ocean freight management platform.