Logistics 4.0 Hits $63 Billion: Why the Convergence of AI, IoT, and Cloud Is Creating an Unstoppable Freight Tech Stack

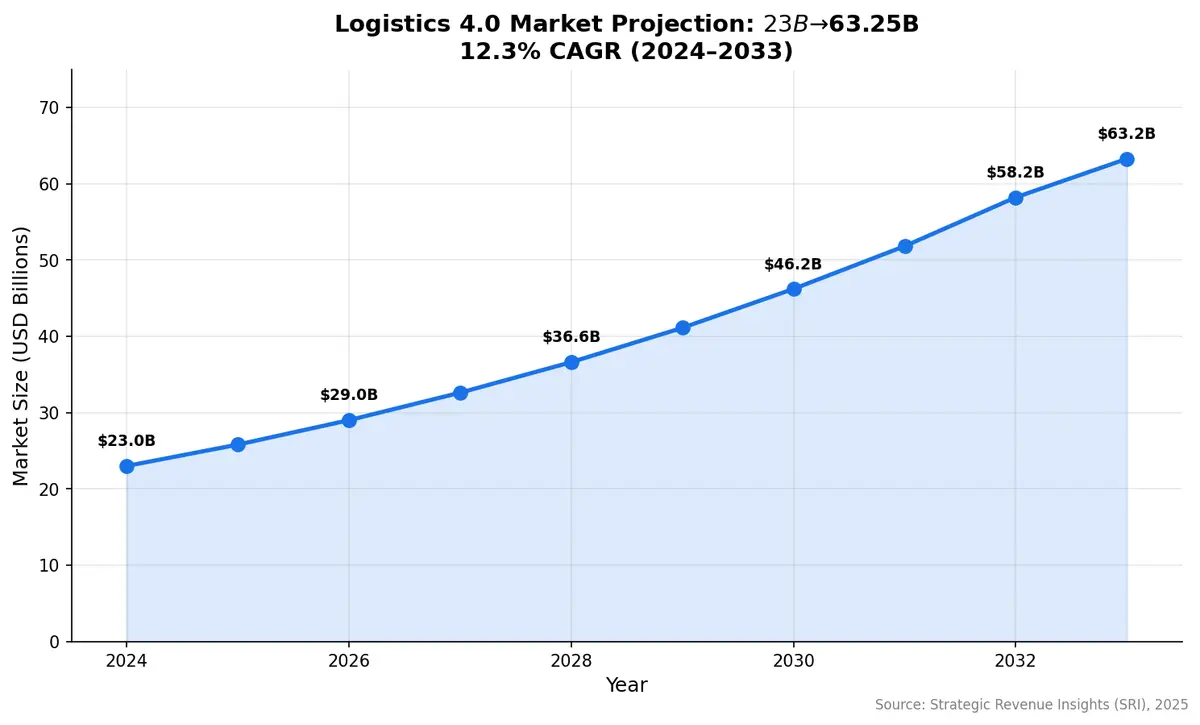

The logistics industry isn't just digitizing — it's converging. Three technologies that spent a decade maturing in isolation are now fusing into a unified freight tech stack that's rewriting how goods move around the world. The Logistics 4.0 market, valued at roughly $23 billion in 2024, is projected to reach $63.25 billion by 2033, growing at a 12.3% CAGR. That trajectory isn't driven by any single breakthrough — it's the convergence of AI decision-making, IoT sensing, and cloud orchestration that's making it unstoppable.

What Is Logistics 4.0, Exactly?

Logistics 4.0 borrows its name from Industry 4.0 — the broader movement toward cyber-physical systems in manufacturing and supply chain. But where Industry 4.0 focuses on factory floors, Logistics 4.0 targets everything between the factory door and the customer's hands: transportation, warehousing, last-mile delivery, and the data flows connecting them.

The core idea is straightforward: instead of disconnected systems making siloed decisions, a unified technology stack senses conditions in real time (IoT), processes that data intelligently (AI/ML), and orchestrates actions across the network (cloud platforms). The result is a logistics operation that adapts continuously rather than reacting after the fact.

The Three Pillars of the Freight Tech Stack

Pillar 1: AI Decision-Making

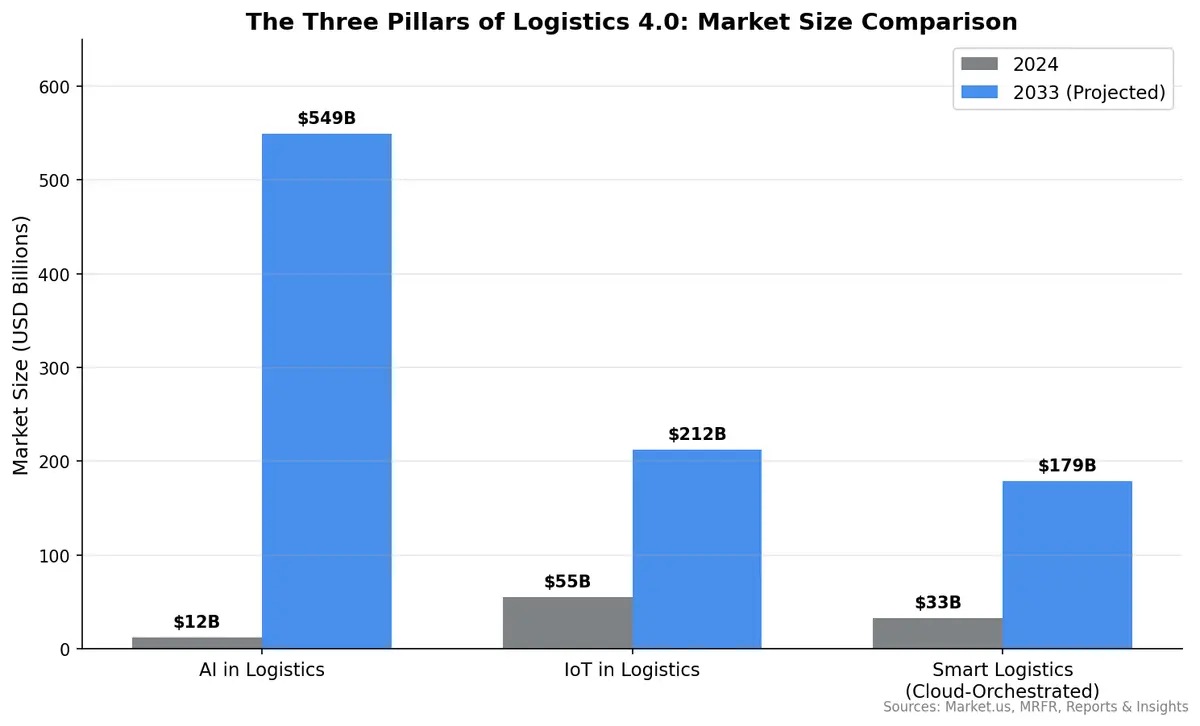

AI in logistics has moved well beyond route optimization demos. The global AI in logistics market is projected to explode from $12 billion in 2023 to $549 billion by 2033 — a staggering 46.7% CAGR — as machine learning penetrates every layer of the supply chain. Yet according to Gartner, only 23% of supply chain organizations currently have a formal AI strategy, signaling massive headroom for adoption.

What AI does today in freight:

- Demand forecasting — Gartner predicts 70% of large organizations will adopt AI-based supply chain forecasting by 2030

- Dynamic pricing — Carrier rate predictions that adjust in real time based on capacity, weather, and demand signals

- Exception management — AI triaging shipment exceptions before humans even see them

- Document processing — Bills of lading, customs forms, and PODs parsed and validated automatically

Pillar 2: IoT Sensing

The IoT in logistics market reached an estimated $55–60 billion in 2024 and is growing at double-digit rates, with projections reaching over $200 billion by 2035. IoT in warehouse management alone hit $11.26 billion in 2024 and is on track for $17.93 billion by 2030, per Grand View Research.

IoT provides the sensory nervous system that Logistics 4.0 needs:

- GPS and telematics — Real-time vehicle tracking with engine diagnostics

- Temperature and humidity sensors — Critical for cold chain compliance and pharmaceutical logistics

- Smart pallets and containers — Weight, shock, tilt, and location data from the cargo itself

- Warehouse sensors — Occupancy tracking, environmental monitoring, equipment utilization

The shift isn't just more sensors — it's cheaper, longer-lasting, and more connected sensors. 5G and LPWAN networks are making it economically viable to instrument every pallet, not just every truck.

Pillar 3: Cloud Orchestration

Cloud is the connective tissue. Without it, AI models sit in data science notebooks and IoT sensors generate noise instead of signals. Cloud-native TMS and WMS platforms provide:

- Unified data lakes — Every sensor reading, every booking, every invoice in one queryable store

- API-first architecture — Carriers, shippers, 3PLs, and customs brokers connected through standard integrations

- Elastic compute — Spinning up AI inference when needed, scaling down when traffic drops

- Multi-tenant collaboration — Shippers and carriers sharing a single source of truth without data silos

The smart logistics market — essentially the cloud-orchestrated intersection of these technologies — was valued at $32.6 billion in 2024 and is expected to reach $178.6 billion by 2033 at a 20.8% CAGR.

Where Convergence Gets Real

The real power of Logistics 4.0 isn't in any single pillar — it's in what happens when they work together.

Predictive ETA with sensor fusion: An AI model doesn't just calculate ETA from distance and speed. It ingests real-time traffic (IoT), weather forecasts (cloud API), driver HOS status (ELD data), and historical lane performance (data lake) to produce an ETA that updates every few minutes. When the prediction shifts, the cloud platform automatically notifies the consignee, adjusts dock scheduling, and rebooks downstream carriers.

Autonomous exception handling: A temperature sensor on a reefer trailer detects a 3°F deviation. The IoT gateway streams the alert to the cloud platform. An AI model evaluates severity — is it a door-open event or a compressor failure? Based on classification, it either logs the deviation or triggers an automated re-routing to the nearest cold storage facility, generates a quality incident report, and notifies the shipper's quality team.

Dynamic load optimization: Cloud platforms aggregate real-time capacity data from hundreds of carriers (API). AI models match available truck space with pending shipments based on predicted demand. IoT-enabled pallets confirm actual dimensions and weights. The result: fewer empty miles, better utilization, and lower per-unit costs.

The Adoption Gap Is the Opportunity

Despite the explosive market growth, most logistics organizations are still early in their Logistics 4.0 journey. Gartner's finding that only 23% have a formal AI strategy means the other 77% are either experimenting ad hoc or haven't started. That gap between market potential and actual adoption is where the next five years of competitive advantage will be won.

The companies pulling ahead share common traits:

- Platform-first thinking — They chose cloud-native TMS/WMS platforms that can ingest IoT data and run AI models, rather than bolting AI onto legacy systems

- Data as a strategic asset — They instrumented their operations early, building the data moats that make AI models increasingly accurate

- Iterative deployment — They started with one use case (often shipment visibility), proved ROI, and expanded

CXTMS: Built for the Convergence

CXTMS was designed from the ground up as a Logistics 4.0 platform. Instead of retrofitting AI onto a 20-year-old architecture, CXTMS provides:

- Cloud-native multi-modal TMS — Ocean, air, trucking, and parcel on one platform with real-time data flows

- AI-powered automation — From document parsing to exception management, with machine learning models that improve with every shipment

- IoT integration layer — Ingest sensor data from any device or gateway, correlate it with shipment records, and trigger automated workflows

- Open API architecture — Connect carriers, customs brokers, warehouses, and ERP systems through standard integrations

The convergence of AI, IoT, and cloud isn't a future trend — it's the present reality reshaping freight. The $63 billion question isn't whether Logistics 4.0 will dominate. It's whether your tech stack is ready for it.

Ready to build your Logistics 4.0 freight tech stack? Contact CXTMS for a demo and see how AI, IoT, and cloud converge on one platform.