Cargo Insurance Goes Digital: How AI and Embedded InsurTech Are Transforming Freight Risk Management

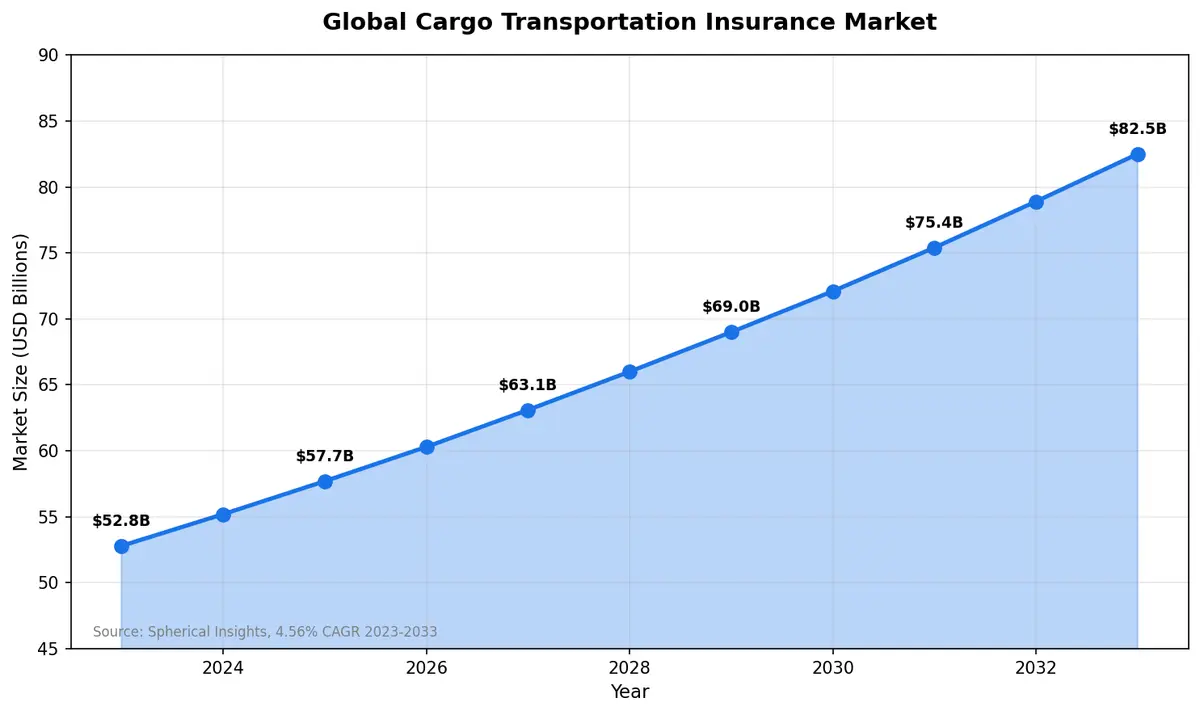

The global cargo transportation insurance market, valued at $52.8 billion in 2023, is projected to reach $82.5 billion by 2033 — growing at a 4.56% CAGR. But the real story isn't the market size. It's how profoundly technology is reshaping every layer of freight risk management, from how policies are priced to how claims are settled.

For decades, cargo insurance operated on paper-heavy processes, manual underwriting, and claims cycles measured in weeks or months. In 2026, that model is collapsing under the weight of digital transformation. AI-driven claims triage, embedded coverage at the point of booking, and IoT-powered risk assessment are turning freight insurance from a slow, reactive cost center into a fast, proactive competitive advantage.

The Underinsurance Crisis Driving Digital Adoption

Here's a sobering reality: the majority of freight shipments move with inadequate coverage. Standard carrier liability for LTL shipments caps at just $0.50 per pound — meaning a 500-pound pallet of electronics worth $50,000 would net a shipper just $250 in a total loss scenario.

This gap between carrier liability and actual cargo value has fueled an underinsurance crisis that costs shippers billions annually. Traditional insurance procurement — calling brokers, waiting for quotes, managing paper certificates — creates enough friction that many shippers simply roll the dice.

Digital InsurTech platforms are solving this by eliminating that friction entirely.

Embedded Insurance: Coverage at the Point of Booking

The most transformative shift in cargo insurance is the move toward embedded coverage — insurance that's offered and activated directly within TMS platforms, load boards, and freight marketplaces at the moment a shipment is booked.

Companies like Loadsure have pioneered this approach, integrating via API directly into transportation management systems so that freight brokers and carriers can secure supplemental cargo coverage in seconds rather than hours or days. Their platform delivers insurance certificates in under 60 seconds and processes claims in under three days — a dramatic improvement over traditional timelines.

The embedded model works because it meets shippers where they already are. Instead of requiring a separate insurance procurement workflow, coverage becomes a checkbox within the booking process. This convenience factor alone is driving adoption rates that traditional insurance channels never achieved.

What embedded freight insurance looks like in practice:

- Quote generation: Real-time, data-driven pricing based on commodity type, route, carrier history, and weather conditions

- Policy activation: One-click coverage at the point of load tender or booking confirmation

- Certificate delivery: Instant digital certificates — no waiting for email attachments from brokers

- Claims initiation: Photo-based damage reporting directly from delivery confirmation workflows

AI Claims Automation: From Weeks to Hours

The insurance industry's 2026 outlook is defined by one theme: operationalizing AI at scale. In cargo insurance, this means automating the claims lifecycle that has historically been the industry's biggest pain point.

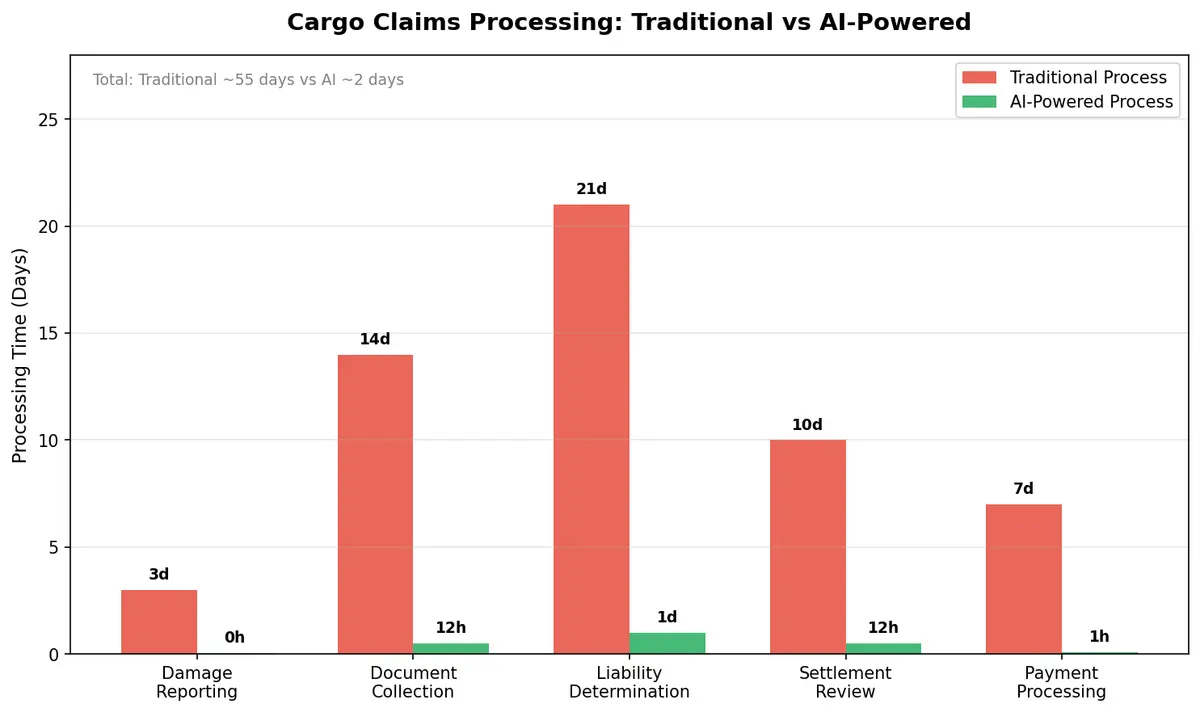

Traditional cargo claims involve manual damage assessment, document collection across multiple parties, liability determination, and settlement negotiation. The average freight claim takes 30 to 90 days to resolve. AI is compressing this timeline dramatically.

Modern AI claims systems use:

- Computer vision to assess damage from photos submitted at delivery, automatically estimating loss severity

- Natural language processing to extract relevant details from bills of lading, delivery receipts, and incident reports

- Predictive models to flag potentially fraudulent claims before they enter the manual review queue

- Automated triage that routes simple claims (clear liability, documented damage, below threshold amounts) straight to payment without human intervention

The result is that straightforward cargo claims — which represent the majority of all claims by volume — can be resolved in hours rather than weeks. Complex claims still require human adjusters, but AI pre-processes the documentation and provides initial assessments that accelerate even those cases.

Telematics and IoT: Risk Prevention Over Risk Transfer

The convergence of IoT sensors and insurance is shifting the industry's value proposition from pure risk transfer to active risk prevention. Telematics devices tracking temperature, humidity, shock, tilt, and location in real time create a continuous risk profile for every shipment.

Insurers are using this data in two powerful ways:

Usage-based pricing: Instead of blanketing entire commodity classes with uniform rates, IoT-enabled policies adjust premiums based on actual conditions. A refrigerated shipment with continuous temperature compliance data gets better rates than one without monitoring. A carrier with dashcam-verified safe driving patterns pays less than one with no telematics.

Proactive loss prevention: When sensors detect a temperature excursion in a pharmaceutical shipment or excessive vibration on a fragile goods load, AI systems can trigger real-time alerts — allowing intervention before damage occurs rather than filing a claim after the fact. GEICO and Motive's fleet safety partnership exemplifies this trend, using AI-powered dashcams to reduce accidents and lower premiums simultaneously.

The Digital Insurance Tech Stack for Freight

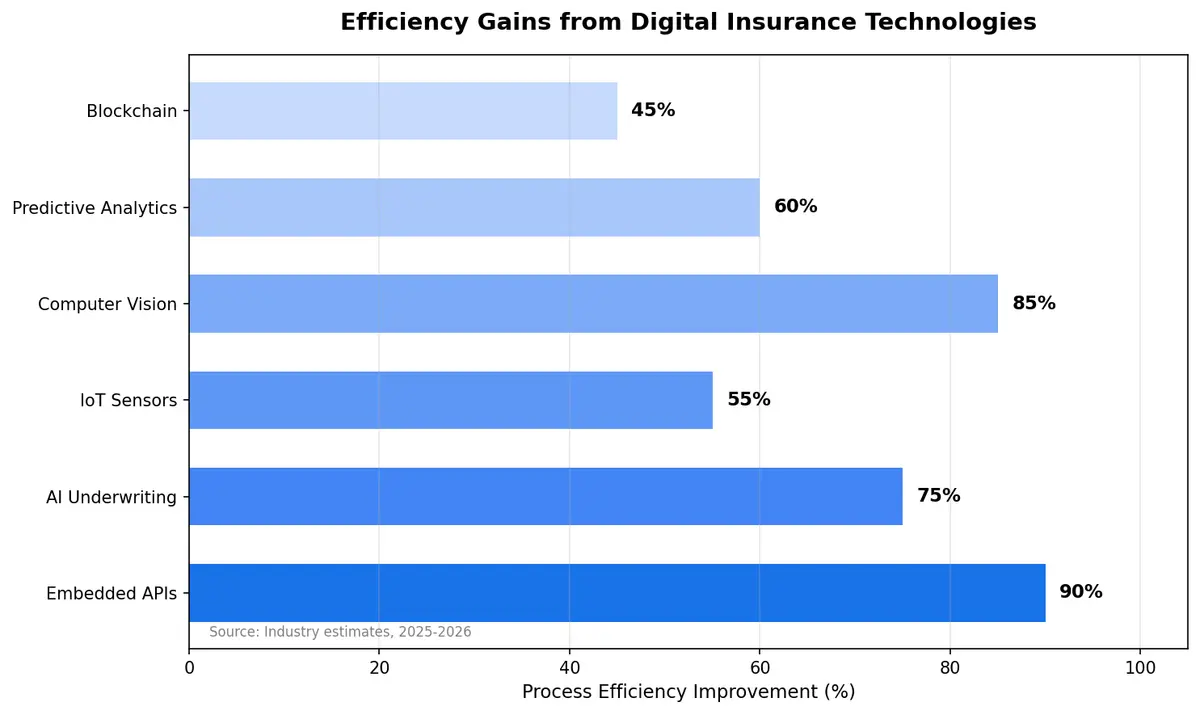

The emerging freight insurance technology stack integrates several layers:

| Layer | Function | Impact |

|---|---|---|

| Embedded APIs | Insurance at point of booking | 10x faster policy issuance |

| AI Underwriting | Real-time risk scoring | Dynamic, per-shipment pricing |

| IoT Sensors | Continuous condition monitoring | 40-60% reduction in preventable losses |

| Computer Vision | Automated damage assessment | Claims resolved in hours, not weeks |

| Blockchain | Immutable shipment records | Faster dispute resolution |

| Predictive Analytics | Loss forecasting | Proactive risk mitigation |

For shippers, this stack means lower premiums, faster claims, and better coverage. For carriers, it means demonstrating safety performance translates directly into cost savings. For brokers, embedded insurance becomes a value-added service that strengthens customer relationships.

What This Means for Your Supply Chain

The digitization of cargo insurance isn't a future trend — it's happening now. Shippers who still rely on annual blanket policies and manual claims processes are leaving money on the table and exposing themselves to unnecessary risk.

The winners in 2026 are those integrating insurance workflows directly into their transportation management platforms. Per-shipment coverage, real-time risk monitoring, and automated claims processing aren't luxuries anymore — they're table stakes for modern freight operations.

Modern TMS platforms like CXTMS are building these integrations natively, connecting insurance workflows with shipment execution so that coverage, documentation, and claims management happen within the same system where loads are booked and tracked. The result is fewer coverage gaps, faster resolution when things go wrong, and data-driven insights that continuously improve risk management.

Ready to modernize your freight risk management? Contact CXTMS for a demo of integrated insurance and shipment management workflows.