The CPSC Electronic Filing Mandate: What Every Importer Must Know Before July 2026

Starting July 8, 2026, every importer of consumer products regulated by the U.S. Consumer Product Safety Commission must electronically file certificate of compliance data at the time of entry — no exceptions. This includes low-value shipments claiming the Section 321 de minimis exemption. For the thousands of businesses importing toys, electronics, furniture, and appliances into the United States, the compliance clock is ticking.

What Changed — and Why It Matters Now

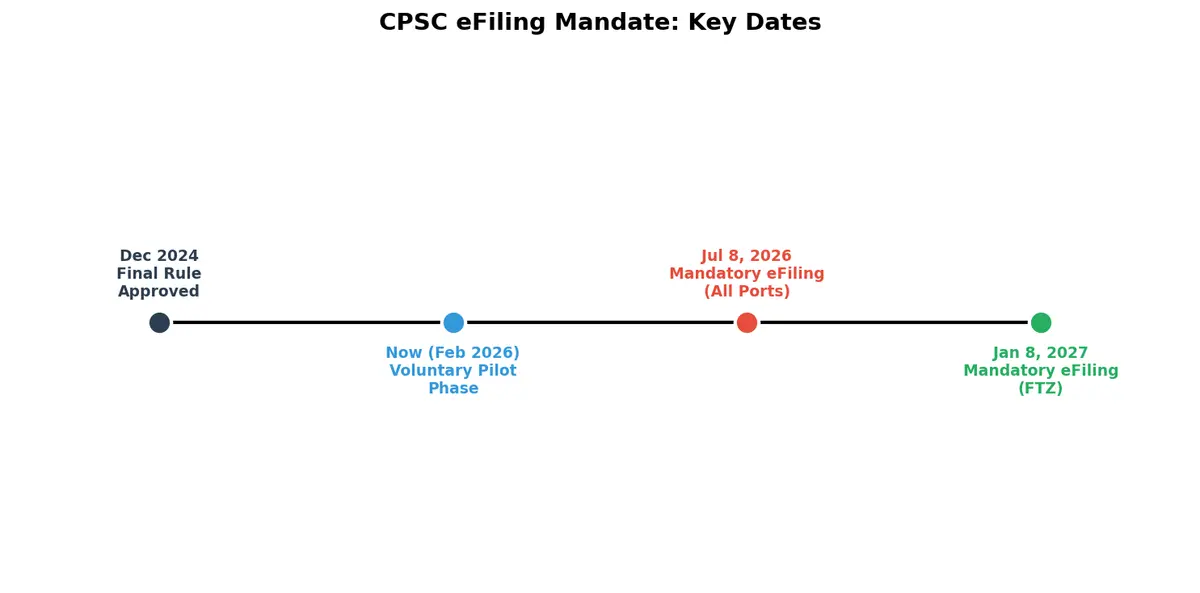

The CPSC finalized this rule in December 2024 after years of voluntary pilot programs. The shift from paper-based certificate reviews to mandatory electronic filing through U.S. Customs and Border Protection's Automated Commercial Environment (ACE) system represents the biggest change to consumer product import compliance in over a decade.

The numbers underscore why this matters. According to a Congressional Research Service report, consumer products under CPSC jurisdiction account for over $1 trillion in annual costs related to deaths, injuries, and property damage. The agency oversees roughly 15,000 product types entering through more than 300 U.S. ports daily. Until now, CPSC relied on requesting certificates after products had already cleared customs — a reactive model that left dangerous goods circulating for weeks before detection.

The eFiling mandate flips that model. Structured, machine-readable data arrives before the product clears entry, enabling CPSC to target high-risk shipments in real time.

Two Deadlines, Two Phases

The rollout is staggered:

- July 8, 2026: Mandatory eFiling for all imports of CPSC-regulated consumer products at standard ports of entry

- January 8, 2027: Mandatory eFiling for products entering through Foreign Trade Zones (FTZ)

The FTZ delay gives importers using bonded facilities additional time to adapt their workflows. But for the vast majority of consumer product importers, the July deadline is the one that counts.

Who Must Comply

The mandate applies broadly:

- Direct importers of any CPSC-regulated consumer product

- Private labelers whose brand appears on regulated products

- Domestic manufacturers (in future phases)

- Section 321 shipments — even de minimis imports under $800 must file

That last point catches many ecommerce sellers off guard. The same de minimis threshold facing regulatory overhaul in 2026 now carries an additional compliance burden: CPSC certificate data must accompany every entry, regardless of value.

Product categories under CPSC jurisdiction include children's products, electronics, household appliances, furniture, clothing textiles, and sporting goods. If you're unsure whether your products qualify, the CPSC's Regulatory Robot tool provides a quick determination.

How Filing Works: Two Methods

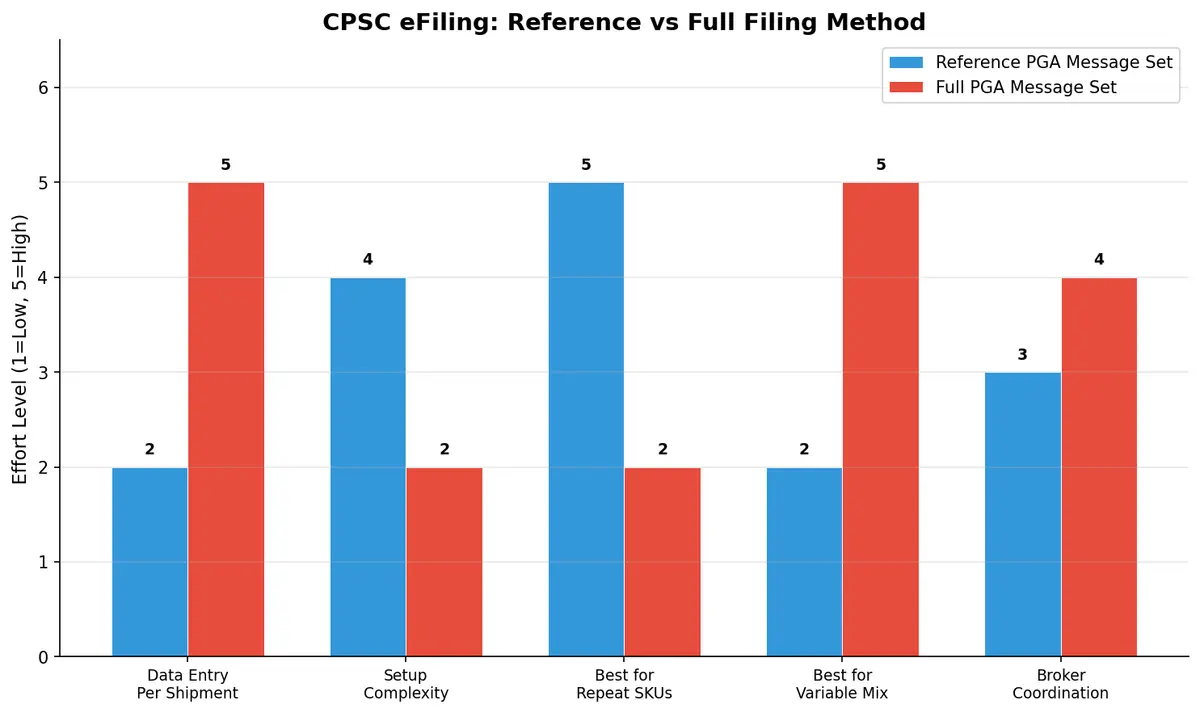

Importers can submit certificate data through ACE using one of two approaches:

Reference PGA Message Set

Pre-file your certificate data in the CPSC Product Registry and receive a Product Code Version Number. At the time of import, your customs broker submits only the reference identifier. This method is ideal for repeat shipments of the same product lines — file once, reference many times.

Full PGA Message Set

Submit all required certificate data directly in ACE for each individual entry. Better suited for importers with highly variable product mixes or infrequent shipments, but more data entry at each filing.

Both methods require coordination with your customs broker, who needs access to all required data elements — including test lab information, applicable safety standards, and product identifiers.

The Compliance Cost Reality

The operational burden isn't trivial. Importers must:

- Audit their product catalogs to identify every SKU subject to CPSC regulation

- Register in the CPSC Product Registry and upload certificate data for each product

- Coordinate with testing labs to ensure certificates are current and properly formatted

- Update customs broker workflows to include PGA message sets in every entry filing

- Retrain staff on the new filing process and data requirements

For large importers handling thousands of SKUs across multiple product categories, this represents a significant systems integration project. Each product retested requires revalidation in the registry. Labs can transmit data via API, but only if the importer's systems are configured to support it.

According to industry estimates reported by Supply Chain Dive, compliance preparation costs for mid-size importers range from $50,000 to $200,000 when accounting for technology upgrades, staff training, and consultant fees.

Penalties for Non-Compliance

CPSC has enforcement teeth. Products that arrive without proper eFiling data face:

- Holds and delays at the port of entry — shipments can be detained indefinitely

- Refusal of admission — goods may be denied entry entirely

- Civil penalties up to $120,000 per violation under the Consumer Product Safety Act

- Criminal penalties for willful violations, including fines up to $250,000 and imprisonment

With CPSC gaining real-time visibility into every entry, enforcement is expected to be swift and automated. The voluntary pilot phase is ending; the agency has signaled zero tolerance for non-compliance after July 8.

How TMS Platforms Bridge the Gap

The eFiling mandate creates a new data integration challenge that sits squarely at the intersection of trade compliance and logistics. Transportation Management Systems that connect customs workflows with shipment execution are uniquely positioned to automate the process.

Key TMS capabilities for CPSC compliance include:

- Product registry synchronization — automatically mapping SKUs to CPSC Product Code Version Numbers

- Customs broker data feeds — pushing PGA message set data to brokers alongside standard entry documentation

- Certificate tracking — monitoring expiration dates and triggering revalidation before test certificates lapse

- Audit trails — maintaining complete filing records for compliance reviews

CXTMS integrates customs documentation workflows directly into the shipment lifecycle, ensuring that CPSC certificate data flows to customs brokers automatically — no manual data entry, no missed filings, no holds at the port.

Preparing Now: A Five-Step Action Plan

With less than five months until the July 8 deadline, importers should act now:

- Inventory your regulated products — Use CPSC's published HTSUS code list to identify affected SKUs

- Create your CPSC Product Registry account — Registration is free at cpsc.gov/eFiling

- Upload certificate data — Start with your highest-volume products and expand

- Coordinate with customs brokers — Confirm they can accept PGA message sets via ACE

- Test the process — File voluntary entries now to identify gaps before mandatory enforcement begins

The CPSC has been hosting webinars and publishing guidance documents throughout the voluntary pilot phase. Importers who haven't engaged yet are running out of runway.

Managing customs compliance across complex import operations? Contact CXTMS to see how automated customs workflows keep your shipments moving — even as regulations evolve.