The De Minimis Crackdown: How the End of Duty-Free Imports Is Reshaping Cross-Border E-Commerce Logistics

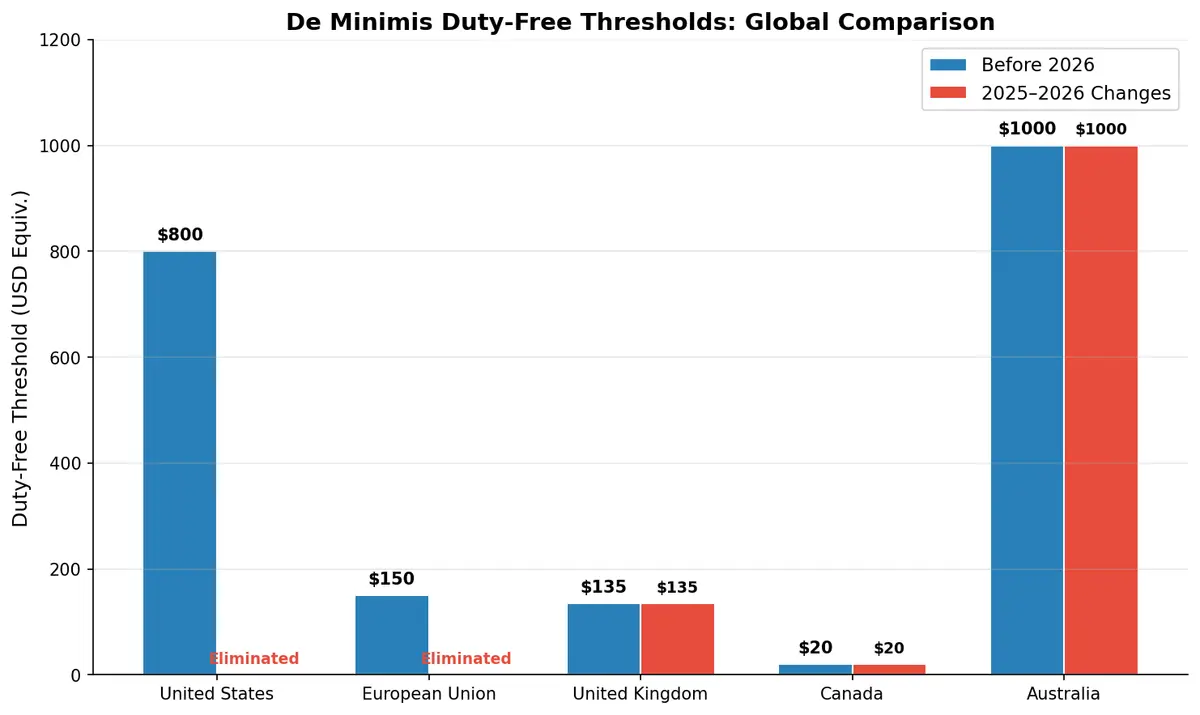

For years, the de minimis exemption was cross-border e-commerce's best-kept open secret. Ship a package under $800 into the U.S. — or under €150 into Europe — and it sailed through customs duty-free, no formal entry required. That loophole fueled the explosive growth of platforms like Temu, Shein, and AliExpress. Now it's gone, and the logistics fallout is just beginning.

The $800 Threshold Is Gone: What Happened

On August 29, 2025, the United States officially eliminated the Section 321 de minimis exemption for shipments from China. Every package — regardless of value — now requires a full customs entry with 10-digit tariff classification codes and applicable duties.

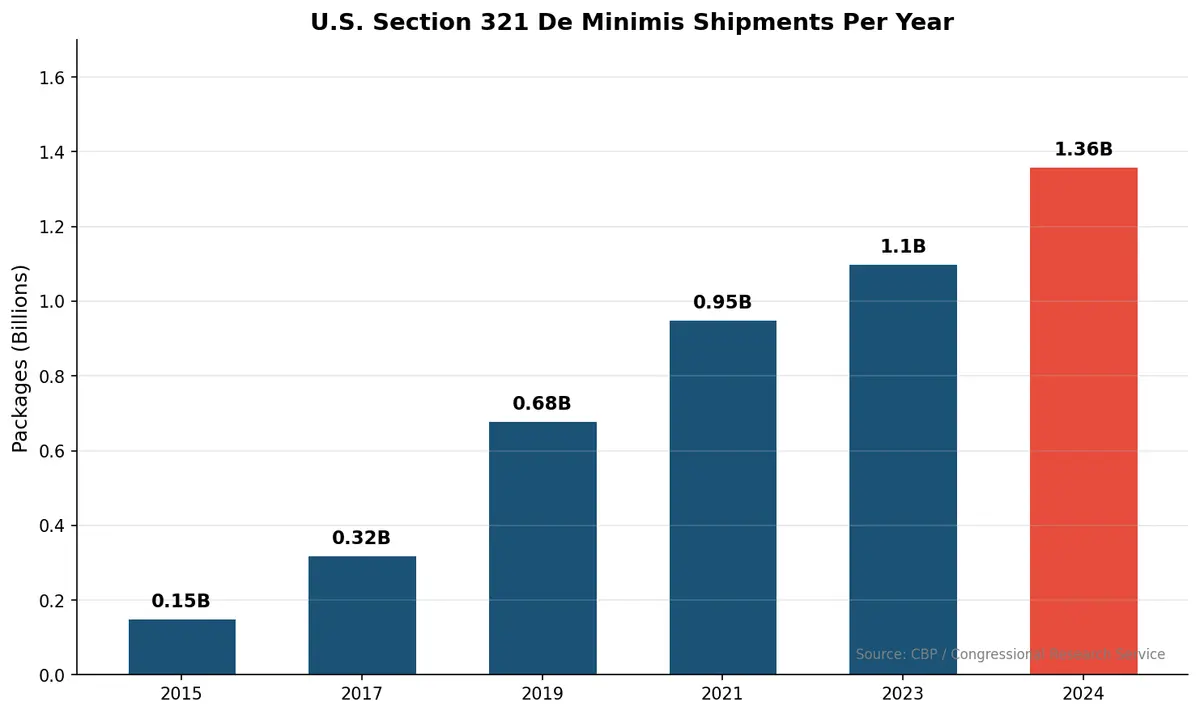

The numbers tell the story of why. By 2024, U.S. Customs and Border Protection was processing over 1.36 billion de minimis shipments annually — roughly 4 million packages per day. As former Homeland Security Secretary Alejandro Mayorkas admitted, "We can't screen all 4 million a day." China accounted for approximately 60% of those shipments.

A temporary postal carve-out allowed low-value mail shipments to use a flat per-package duty of $80–$200 instead of ad valorem rates, but that workaround expired on February 28, 2026. As of now, every import shipment into the U.S. faces full duty assessment.

The EU Doubles Down: €150 Exemption Ending July 2026

The crackdown isn't just American. In November 2025, EU finance ministers formally agreed to abolish the €150 customs duty exemption for low-value e-commerce parcels — two years ahead of the original timeline. Starting July 1, 2026, a transitional €3-per-item duty applies to all imported e-commerce goods, with platforms required to cover a €2 parcel processing fee.

The European Commission explicitly named the targets: platforms like Temu, Shein, and AliExpress that had "exploited the loophole" to flood European markets with ultra-cheap goods while undercutting domestic retailers who collect VAT and duties.

For global sellers, the message is clear: the two largest consumer markets on Earth are simultaneously closing the duty-free door.

Impact on E-Commerce Fulfillment Models

The de minimis elimination fundamentally breaks the direct-to-consumer shipping model that Chinese e-commerce platforms built their businesses on. Here's what's changing:

Cost increases are immediate. A $15 product from Shein that previously entered the U.S. duty-free now faces tariffs that can exceed the product's value. With combined tariff rates on Chinese goods reaching 145% in some categories, the math simply doesn't work for ultra-low-price sellers shipping direct from Chinese warehouses.

Customs processing bottlenecks are real. CBP must now process formal entries for millions of additional shipments daily. Transit times for cross-border e-commerce have already increased by 2–5 days at major ports of entry as the system adapts.

Small sellers are hit hardest. Large platforms can invest in compliance infrastructure and bonded warehouse networks. Independent cross-border sellers face a compliance burden — tariff classification, duty calculation, customs brokerage — that many aren't equipped to handle.

How Shippers and 3PLs Must Adapt

The post-de minimis world demands new logistics strategies:

Bonded Warehouses and Local Inventory

The most significant shift is the move from direct cross-border shipping to pre-positioned domestic inventory. Temu and Shein are already building U.S. and EU warehouse networks, converting from a cross-border model to a localized fulfillment model. For 3PLs, this represents a massive opportunity — demand for domestic e-commerce warehousing is surging.

Compliance Automation

Every shipment now needs accurate tariff classification, duty calculation, and customs filing. Manual processes that worked when only formal entries required documentation are impossibly slow at e-commerce volumes. Automated customs compliance — from HS code classification to duty drawback management — isn't optional anymore; it's the price of admission.

Consolidation and Deconsolidation

Smart shippers are consolidating small parcels into bulk shipments, clearing customs once, then deconsolidating domestically. This reduces per-unit customs costs and processing time but requires sophisticated logistics orchestration.

Nearshoring Acceleration

For sellers serving both U.S. and EU markets, manufacturing in Mexico (for U.S. access via USMCA) or Turkey (for EU access via customs union) suddenly looks far more attractive than shipping from China and paying full duties on every parcel.

What This Means for Logistics Technology

The de minimis crackdown is fundamentally a data problem. Customs authorities now need tariff codes, product descriptions, country of origin, and declared values for billions of additional shipments annually. The platforms and logistics providers that can automate this data flow will thrive; those that can't will drown in compliance costs and delays.

Modern TMS platforms must now integrate customs automation directly into the shipment workflow — classifying goods, calculating duties, generating customs documentation, and filing entries electronically, all before a package leaves the origin warehouse.

Navigating the post-de minimis landscape? Contact CXTMS to see how our customs automation and cross-border compliance tools keep your shipments moving without surprises at the border.