Embedded Freight Finance: How Fintech Is Bringing Instant Payments and Factoring Directly Into TMS Platforms

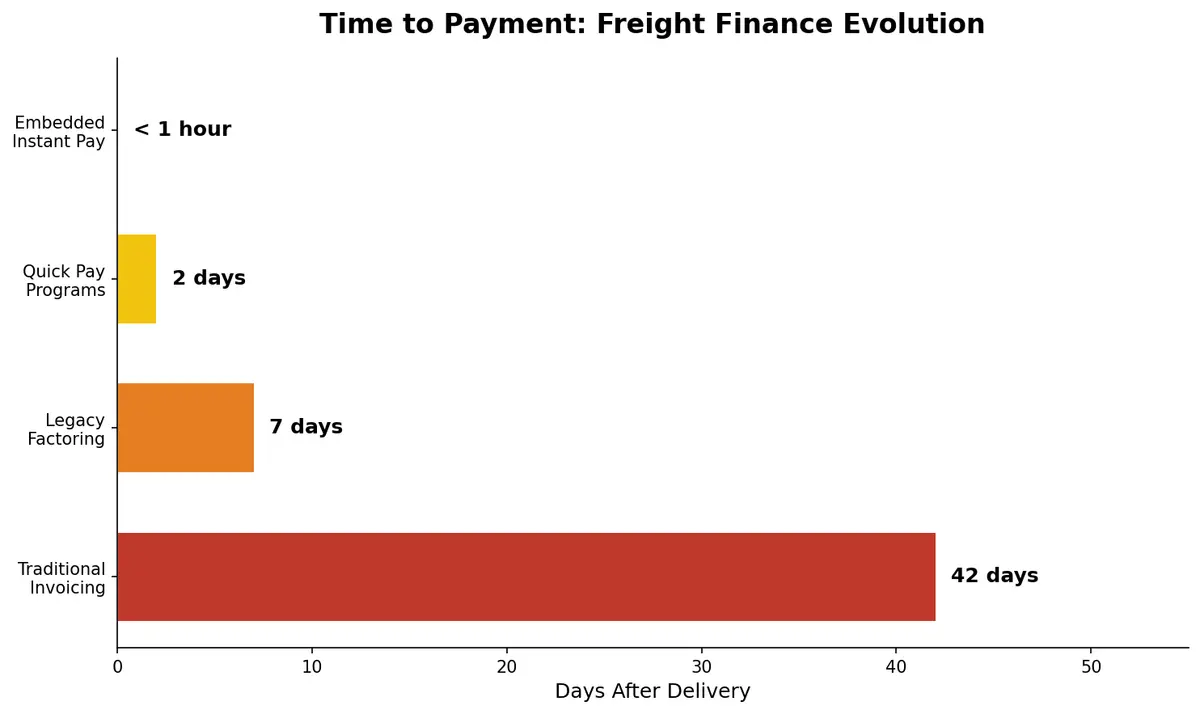

The average small carrier waits 35 to 45 days to get paid after delivering a load. For an owner-operator running a single truck, that gap between delivery and payment isn't an inconvenience — it's an existential threat. Fuel, insurance, maintenance, and tolls don't wait for net-30 terms.

That's why freight factoring has quietly become a $200 billion industry. But in 2026, the way carriers access capital is undergoing a radical transformation. Financial services are no longer separate from the platforms where freight is booked, tracked, and managed. They're being embedded directly into TMS and load board ecosystems — and the implications for carriers, brokers, and shippers are enormous.

The Freight Cash Flow Crisis

The trucking industry's payment problem is structural. Shippers pay brokers on net-30 to net-60 terms. Brokers pay carriers on similar timelines. But carriers — especially the 97% of U.S. trucking companies operating fewer than 20 trucks — need cash now to keep rolling.

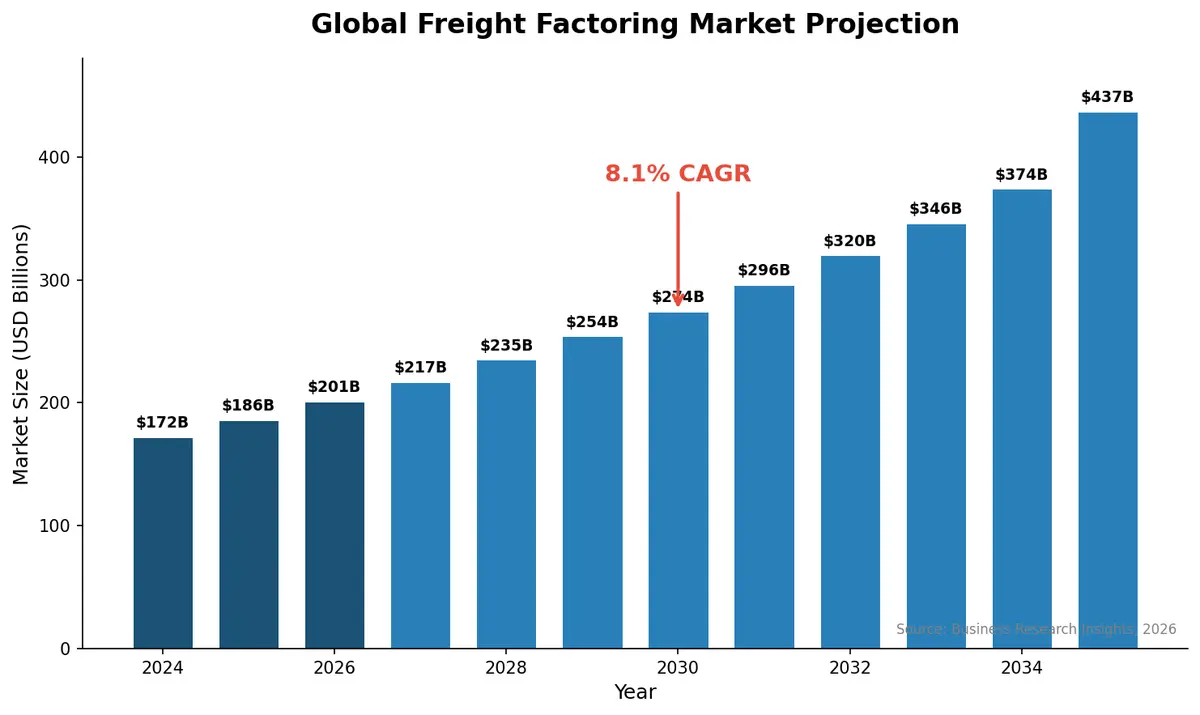

Traditional freight factoring fills this gap by purchasing unpaid invoices at a discount, typically charging 2% to 5% of the invoice value. According to Business Research Insights, the global freight factoring market reached approximately $200.76 billion in 2026 and is projected to hit $437.4 billion by 2035, growing at an 8.1% CAGR.

But legacy factoring is friction-heavy. Carriers sign up with a separate factoring company, submit paperwork, wait for verification, and often face recourse clauses that claw back advances if a broker doesn't pay. The process can take hours or days — hardly "instant."

The Embedded Finance Revolution

Embedded finance — integrating financial services directly into non-financial platforms — has already transformed consumer tech. Buy-now-pay-later at e-commerce checkout. Insurance bundled into ride-hailing apps. Now it's coming for freight.

The concept is simple: instead of forcing carriers to leave their TMS or load board to find financing, the financing meets them where they already work. Book a load, deliver it, get paid — all within the same platform, often within minutes.

DAT Freight & Analytics made the most significant move in this direction when it acquired Outgo in May 2025, bringing instant payment capabilities directly into the DAT One marketplace — the industry's largest freight exchange. Carriers who find and book loads on DAT can now get paid almost immediately after delivery confirmation, without ever leaving the platform.

The Consolidation Wave

The DAT-Outgo deal wasn't an isolated event. It signaled a broader industry consolidation where freight platforms are racing to become all-in-one ecosystems:

- DAT + Outgo: Instant payments embedded into the largest load board, creating a book-and-get-paid workflow

- Triumph Financial: Building a vertically integrated freight payments network combining factoring, banking, and audit through its TriumphPay platform

- OTR Solutions: Expanding from traditional factoring to offering 24/7/365 truly instant, non-recourse funding for carriers of all sizes

- Nolan Transportation Group + Epay Manager: As of January 2026, NTG migrated all carrier payments to the Epay Manager network, offering carriers flexible payment options including same-day ACH and fuel card advances

These moves reflect a fundamental insight: the platform that controls payments controls the ecosystem. When a carrier can find loads, manage documents, and get paid instantly — all in one place — switching costs become enormous.

Why Instant Payments Change Everything

The shift from net-30 factoring to instant embedded payments has cascading effects across the freight ecosystem:

Carrier Retention and Capacity Access

Brokers offering instant or same-day payment consistently report higher carrier acceptance rates. In a tight capacity market, the ability to pay fast is a competitive weapon. Small carriers increasingly choose loads based not just on rate per mile but on speed to cash.

Reduced Administrative Overhead

Traditional factoring requires separate contracts, credit checks, invoice submission, and dispute resolution — all managed outside the TMS. Embedded finance eliminates this parallel workflow. Payment becomes a feature, not a separate business relationship.

Better Data, Better Decisions

When financial transactions flow through the same platform as operational data, the analytics possibilities multiply. Platforms can assess carrier creditworthiness based on delivery performance, offer dynamic pricing on factoring fees based on broker payment history, and identify cash flow patterns that predict capacity crunches.

Lower Costs for Carriers

Competition among embedded finance providers is pushing factoring fees down. When payment is integrated and automated — no paper invoices, no manual verification — the cost of servicing each transaction drops. Those savings increasingly flow back to carriers in the form of lower discount rates.

TMS-Integrated Financial Workflows

The most sophisticated implementations go beyond simple quick-pay buttons. Modern TMS platforms are building complete financial ecosystems:

- Automated invoice generation tied to proof-of-delivery confirmation

- Dynamic factoring rates based on shipper/broker credit scores within the platform

- Fuel advance programs that release partial payment at pickup

- Multi-modal settlement handling LTL, FTL, and intermodal payments through unified workflows

- Real-time payment status tracking giving carriers full visibility into when funds will arrive

For shippers and brokers, these integrations mean faster carrier onboarding, reduced payment disputes, and better carrier relationship management — all critical in a market where reliable capacity is the ultimate competitive advantage.

What This Means for the Industry

The embedded freight finance trend points toward a future where financial services are invisible infrastructure — always present, never requiring separate platforms or relationships. The winners will be TMS providers and freight marketplaces that can offer the most seamless book-to-pay experience.

For carriers, this means less time chasing payments and more time moving freight. For brokers, it means a powerful tool for attracting and retaining capacity. And for the freight finance industry itself, it means adapt or become irrelevant — because the platforms are coming for your lunch.

Need a TMS that streamlines your entire freight workflow — from booking to payment? Contact CXTMS for a demo and see how integrated operations can transform your logistics.