The Freight Brokerage Tech Revolution: How Smart TMS and AI Are Redefining Broker Competitiveness in 2026

The three-year freight recession didn't just thin the herd of freight brokers—it rewired what it takes to survive. As 2026 unfolds, the brokerages still standing face a brutal reality: spot rates are rising due to compliance enforcement rather than volume growth, and both shippers and carriers can increasingly cut brokers out of the equation. Technology is no longer a competitive advantage. It's a survival requirement.

The Post-Recession Reckoning

According to FreightWaves, 2026 is a "resilience-building year" for freight brokers, not a recovery year. Volumes remain suppressed while costs climb across fuel, insurance, and equipment. The traditional brokerage spread—the gap between what brokers charge shippers and pay carriers—is narrowing to razor-thin margins.

Meanwhile, shipper expectations have leaped forward. Research from SupplyChainBrain reveals that 38% of shippers report being "slightly satisfied" or "not satisfied at all" with their logistics partners' technological capabilities. Only 45% of logistics service providers have automated their documentation, compliance, and invoicing workflows—leaving the majority stuck in manual processes that erode both margin and customer trust.

The message is clear: brokers who treat their TMS as a daily operating tool rather than a strategic platform are running out of runway.

AI Is Rewriting the Broker Playbook

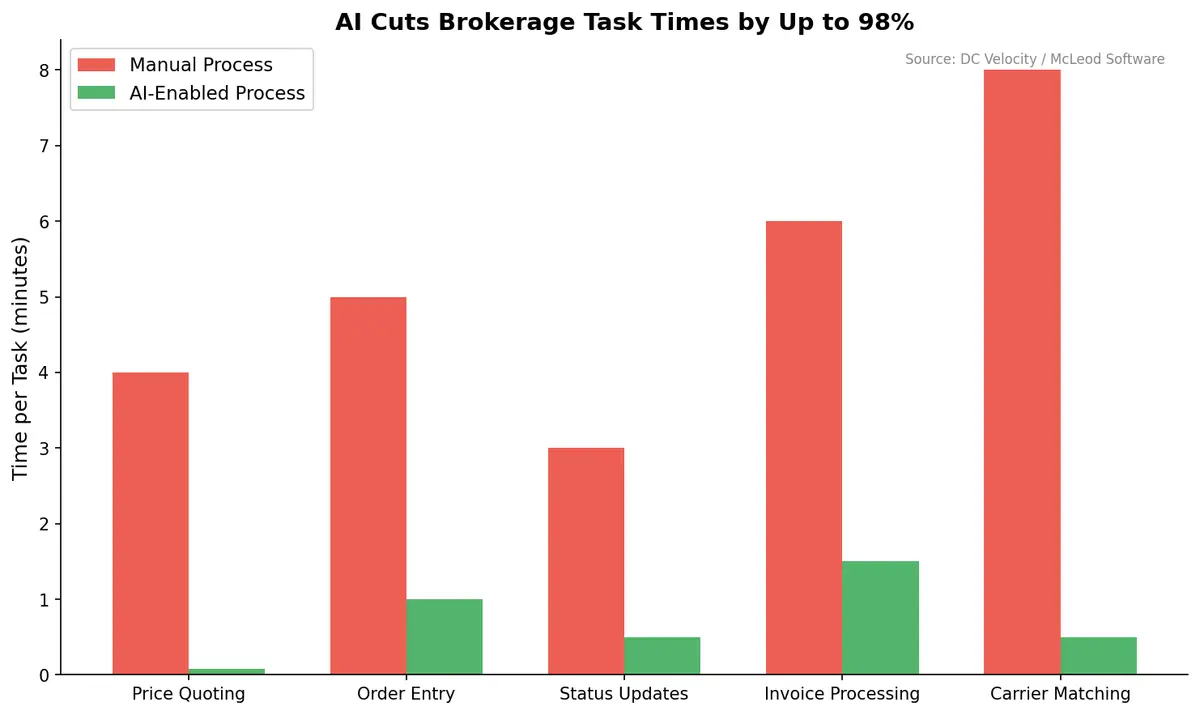

The most dramatic shift happening inside forward-thinking brokerages isn't headcount reduction—it's task compression. According to DC Velocity, AI-enabled processes at leading brokerages are collapsing task times by orders of magnitude:

- Price quoting: From 3–4 minutes manually to 5 seconds with AI

- Order entry: From 4–5 minutes to under 1 minute with AI interpreting email strings

- Status updates: Automated responses generated from TMS data in real time

When a brokerage handles hundreds of quotes and orders per week, those minutes compound into full-time employee equivalents. As McLeod Software's Doug Schrier told DC Velocity: "What you want to do is get the human adding the value and use AI to get the mundane out of the workflow."

But AI in brokerage goes beyond speed. Machine learning models are now pricing loads by analyzing historical lane data, seasonal patterns, fuel indices, and real-time capacity signals simultaneously—producing quotes that are both faster and more accurate than experienced human brokers working spreadsheets.

The Broker Tech Maturity Spectrum

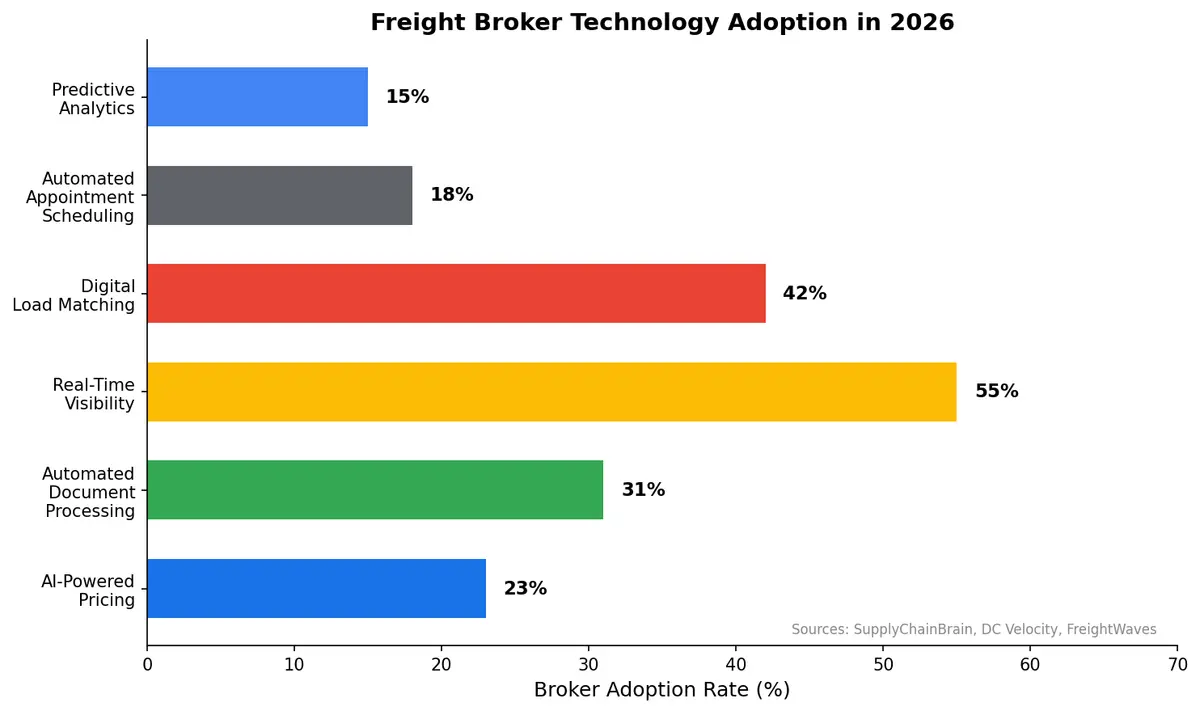

Not all brokerages are adopting at the same pace. The industry is splitting into distinct tiers based on technology maturity:

Tier 1 — AI-Native Brokerages operate with integrated platforms where pricing, matching, tracking, and invoicing flow through a single intelligent system. These brokerages handle higher volumes per employee and win business on speed and accuracy.

Tier 2 — Digitally Enabled Brokerages have adopted modern TMS platforms with real-time visibility and basic automation but haven't yet integrated AI into pricing or decision-making. They're competitive today but face pressure to evolve.

Tier 3 — Legacy Operators still rely on phone calls, email threads, and disconnected spreadsheets. With 20% of smaller logistics providers reporting "no major modernization initiatives" compared to just 6% of larger firms, the gap is widening fast.

Five Technologies Separating Winners from Losers

1. AI-Driven Dynamic Pricing

Modern broker TMS platforms ingest real-time market data, carrier availability, and historical lane performance to generate dynamic pricing within seconds. This eliminates the "gut feel" pricing that costs brokerages margin on every load.

2. Intelligent Load Matching

Beyond simple proximity-based matching, AI systems now factor in carrier performance history, equipment type, preferred lanes, and even driver patterns to optimize matches. The result: higher acceptance rates and fewer reloads.

3. Automated Document Processing

With 75% of supply chain data still unstructured—trapped in emails, PDFs, and faxes—AI document processing extracts rate confirmations, BOLs, and proof of delivery automatically, feeding clean data into the TMS without human intervention.

4. Predictive Capacity Planning

Rather than reacting to spot market spikes, AI-equipped brokerages anticipate capacity crunches days or weeks in advance, pre-positioning carrier relationships and adjusting pricing strategies proactively.

5. Digital Customer Experience

Shippers increasingly expect self-service portals with real-time tracking, automated status updates, and instant quoting. Brokerages that can't deliver this digital experience are losing RFPs before the first conversation.

The Data Foundation Challenge

The promise of AI in brokerage comes with a critical prerequisite: data quality. As industry veterans note, AI is "not a magic bullet you can easily switch on." The effectiveness of every AI application depends on clean, structured, and comprehensive data flowing through the TMS.

This is where platform choice matters enormously. Brokerages running fragmented systems—one tool for quoting, another for tracking, a spreadsheet for carrier scoring—create data silos that starve AI models of the context they need. An integrated TMS that captures every interaction, transaction, and outcome in a unified data layer becomes the foundation for every AI capability.

Building a Tech-Forward Brokerage in 2026

For brokerages ready to close the technology gap, the roadmap is straightforward:

- Audit your tech stack ruthlessly. Identify every manual process, disconnected system, and data silo. Each one is a margin leak.

- Centralize on a modern TMS. Your TMS should be the single source of truth for every load, carrier, and customer interaction.

- Automate the mundane first. Document processing, status updates, and appointment scheduling offer the fastest ROI.

- Layer in AI pricing and matching. Once your data foundation is solid, AI-driven pricing and load matching deliver compounding returns.

- Measure relentlessly. Track time-per-task, quote accuracy, carrier acceptance rates, and margin-per-load to quantify your technology ROI.

The Competitive Imperative

The freight brokerage industry is undergoing a technology-driven consolidation. Brokerages that embrace AI-powered TMS platforms aren't just operating more efficiently—they're fundamentally changing the economics of their business, handling more volume with fewer errors at tighter margins that still deliver healthy profits.

Those clinging to legacy processes will find themselves squeezed from both sides: losing shippers who demand digital capabilities and losing carriers who prefer working with brokers whose systems make their lives easier.

The freight recession forced painful lessons. The technology revolution rewards those who learned them.

Ready to modernize your freight brokerage operations? Contact CXTMS to see how our integrated TMS platform helps brokerages automate workflows, leverage AI-driven pricing, and deliver the digital experience shippers demand.