The TMS Market Hits a Tipping Point: Why Transportation Management Systems Are No Longer Optional in 2026

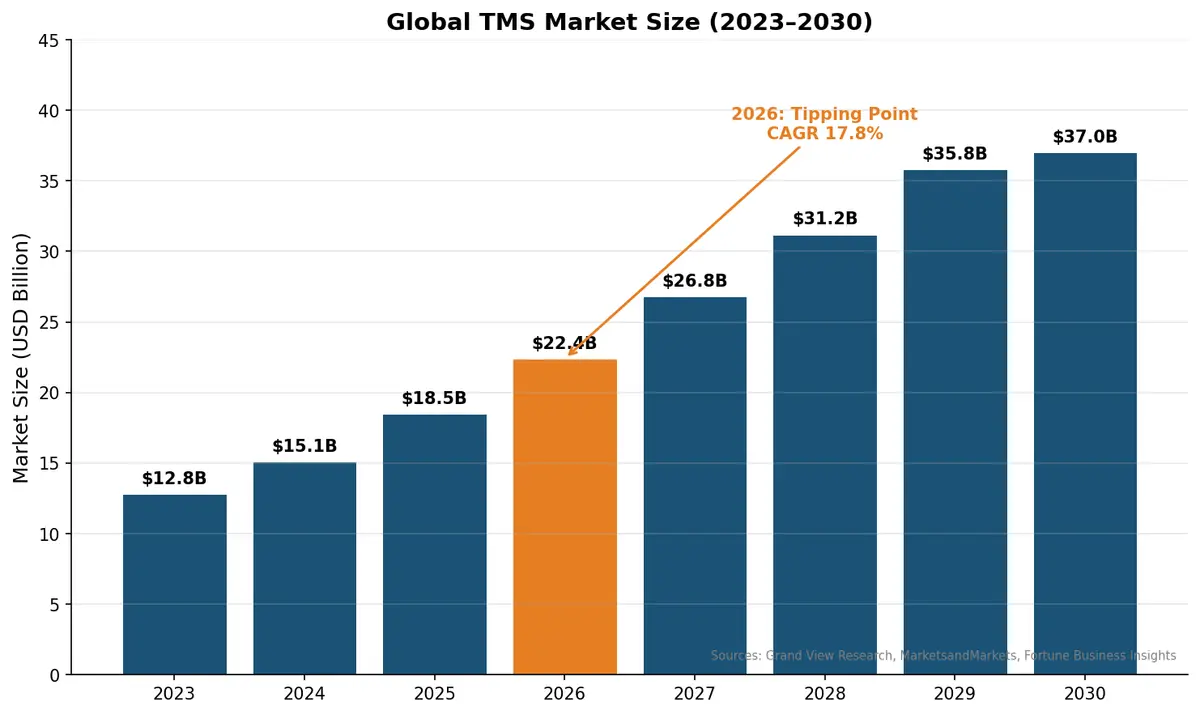

The global transportation management system market is projected to reach $22.4 billion in 2026, up from $18.5 billion in 2025, with analysts forecasting growth to $68 billion by 2033 at a 17.8% CAGR. Those aren't incremental gains — that's an inflection point. And for shippers still managing freight with spreadsheets and phone calls, 2026 is the year the gap between digital-ready companies and everyone else becomes impossible to ignore.

The Numbers Tell the Story

Multiple research firms now converge on the same conclusion: TMS adoption is accelerating faster than at any point in the last decade. Grand View Research pegs the market at $18.56 billion in 2025 growing to $68.36 billion by 2033. Fortune Business Insights projects even higher — $22.35 billion in 2026 reaching $82.43 billion by 2034. MarketsandMarkets offers a more conservative $37 billion by 2030.

The spread in projections reflects different methodologies, but the direction is unanimous: massive, sustained growth.

What's driving this? Three converging forces: the lingering effects of a three-year freight recession that exposed operational weaknesses, rising shipper expectations for real-time visibility, and AI capabilities that are finally moving from marketing slides to production environments.

Why 2026 Is the Inflection Year

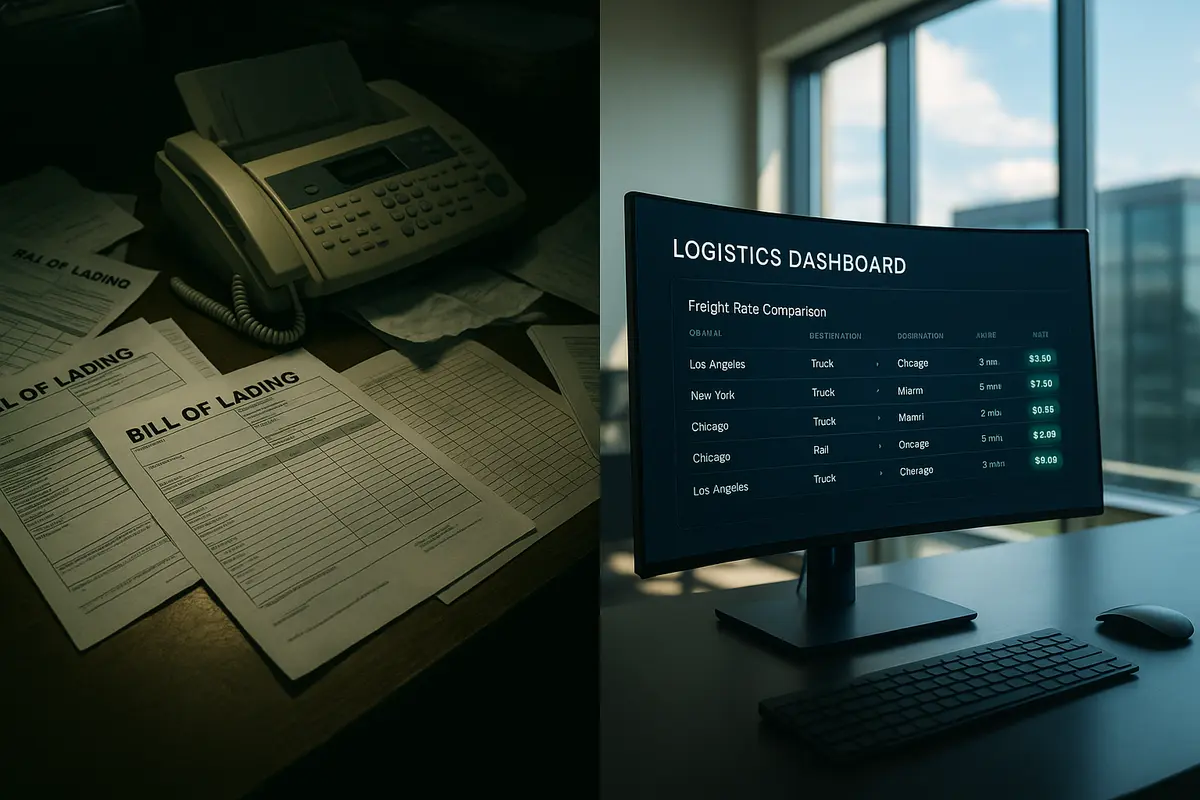

According to Supply Chain Brain, 2026 is the year technology becomes critical for freight forwarders. Companies that proactively build digital capabilities — real-time visibility, digital rate management, automated freight documentation — will be positioned to serve shippers effectively. Those that don't will find themselves competing on price alone, a race to the bottom in an already margin-thin industry.

Brock Johns, director analyst in Gartner's logistics and technology team, reinforced this in a recent Logistics Management analysis: "Cost management is still front and center, and the market doesn't look ready to snap back." The freight recession has forced companies to optimize operations rather than simply wait for volume recovery — and a modern TMS is the primary tool for that optimization.

The same analysis identified nine defining TMS trends for 2026, including rising user expectations, AI integration challenges, and the growing gap between cloud-native platforms and legacy systems.

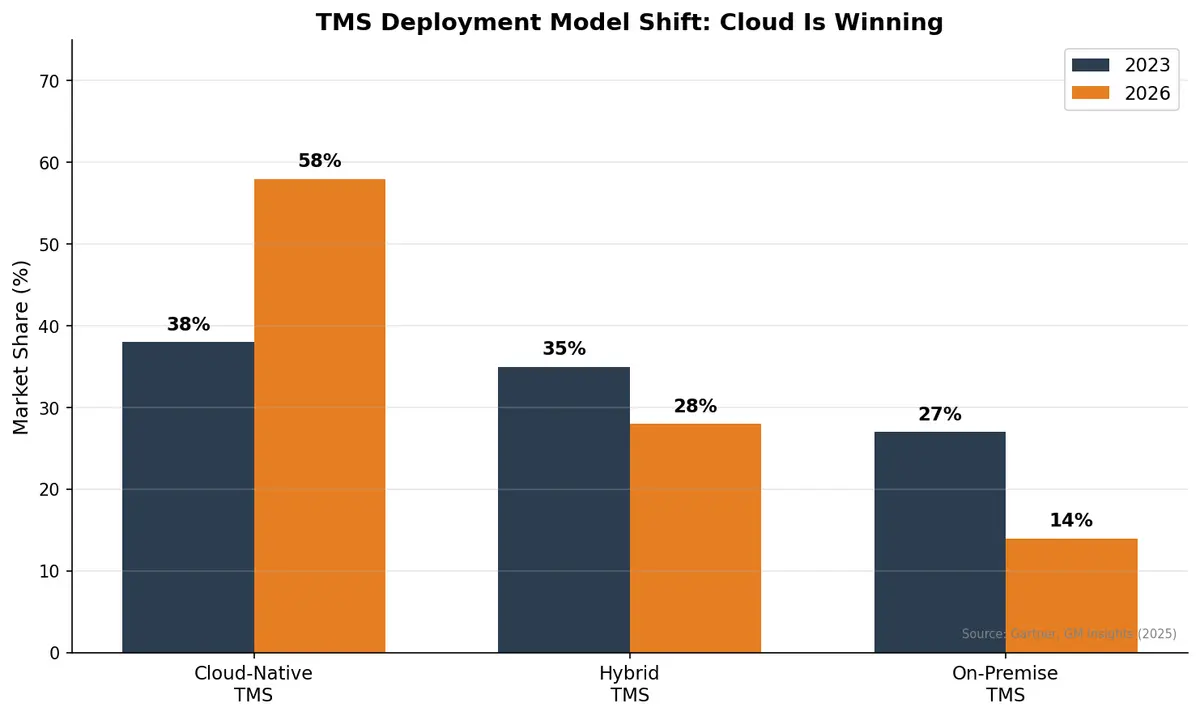

Cloud-Native vs. Legacy: The Great Divide

The deployment model conversation is effectively over. Cloud-native TMS platforms now dominate new implementations, and the gap is widening.

Cloud-native platforms offer faster deployment (weeks instead of months), lower upfront costs, automatic updates, and the API-first architecture that modern supply chains demand. Legacy on-premise systems, while still running at large enterprises, increasingly struggle with integration requirements, update cycles, and the real-time data demands of modern logistics.

The shift isn't just about technology preferences. It's about speed to value. Mid-market shippers that once needed 12-18 months and six-figure budgets to implement a TMS can now deploy cloud solutions in 6-8 weeks. That accessibility is what's driving the market's explosive growth.

What Shippers Actually Need in a 2026 TMS

The Gartner TMS landscape has become "more crowded and complex," according to their latest Magic Quadrant report. With dozens of vendors competing for attention, shippers need clarity on what actually matters:

Real-time visibility and tracking — Not just knowing where a shipment is, but predictive ETAs that account for weather, traffic, and carrier performance patterns. Shippers increasingly expect their TMS to tell them what will happen, not just what did happen.

Multi-modal optimization — Freight doesn't move in single modes anymore. A shipment might start as ocean, transition to drayage, move LTL to a distribution center, and finish as parcel. A modern TMS orchestrates all of it from a single platform.

AI-powered decision support — Brandon Hamilton of St. Onge Co. warns shippers to look past AI marketing hype: "Some TMS providers tout that they're AI when they're probably machine learning at best." The real value lies in AI that automates procurement decisions, identifies cost anomalies, and optimizes carrier selection based on actual performance data.

Carrier collaboration tools — The best TMS platforms don't just manage carriers — they create collaborative ecosystems where capacity, rates, and performance data flow both directions. In a soft freight market, carrier relationships matter more than ever.

API-first architecture — Integration isn't optional. A TMS needs to connect seamlessly with ERPs, WMS platforms, carrier systems, customs brokers, and dozens of other supply chain tools. Closed systems that require custom integrations for every connection point are a liability.

The Mid-Market Opportunity

Perhaps the most significant shift in 2026 is TMS accessibility for mid-market shippers. Companies spending $5-50 million annually on freight have historically been underserved — too large for basic shipping tools, too small for enterprise TMS implementations that cost hundreds of thousands of dollars.

Cloud-native platforms have collapsed that barrier. Modern TMS solutions now offer enterprise-grade capabilities at price points accessible to mid-market shippers, with implementation timelines measured in weeks rather than quarters.

This is where the market's real growth is happening. Enterprise TMS adoption was already high. The tipping point in 2026 is mid-market acceleration — thousands of companies implementing their first real TMS because the cost-benefit equation has finally tipped decisively in favor of adoption.

Selection Criteria That Matter

For shippers evaluating TMS platforms in 2026, Hamilton's advice resonates: "Don't be afraid to dig a little deeper during those evaluations." Specifically:

- Ask for real AI use cases — Not demos, but production deployments with measurable outcomes

- Evaluate time-to-value — How fast can you go live with core functionality?

- Test the integration layer — Connect to your actual carriers and systems during evaluation

- Check the carrier network — A TMS is only as good as its ability to work with your carriers

- Assess total cost of ownership — Including implementation, training, integrations, and ongoing support

The Bottom Line

The TMS market isn't just growing — it's fundamentally changing who uses transportation management technology and how they use it. The combination of cloud economics, AI capabilities, and post-recession operational pressures has created a genuine tipping point.

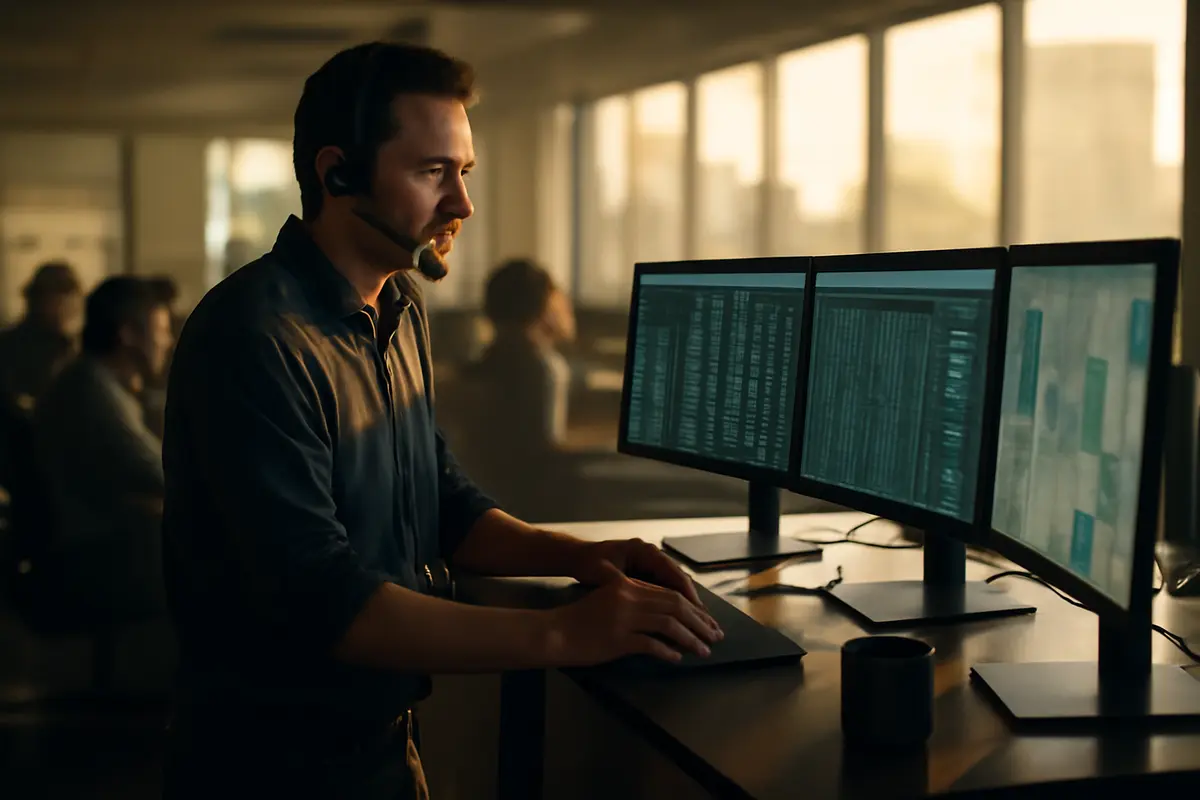

For companies still relying on manual processes, carrier portals, and spreadsheets to manage freight, the competitive disadvantage compounds every quarter. The question in 2026 isn't whether you need a TMS. It's how quickly you can implement one.

Ready to modernize your transportation management? Contact CXTMS for a demo of our cloud-native TMS platform built for the demands of modern logistics.