The Digital Freight Forwarding Market Will Hit $50 Billion by 2031: What This Means for Shippers Still Using Manual Processes

The digital freight forwarding market is on track to hit $50.14 billion by 2031, growing at a 25% CAGR according to DataM Intelligence. Meanwhile, Mordor Intelligence pegs the broader market at $119 billion by 2031 with a 19.2% CAGR, valuing it at $49.4 billion in 2026 alone. Either way, the message is the same: digital freight forwarding isn't a niche experiment anymore — it's becoming the default way goods move across borders.

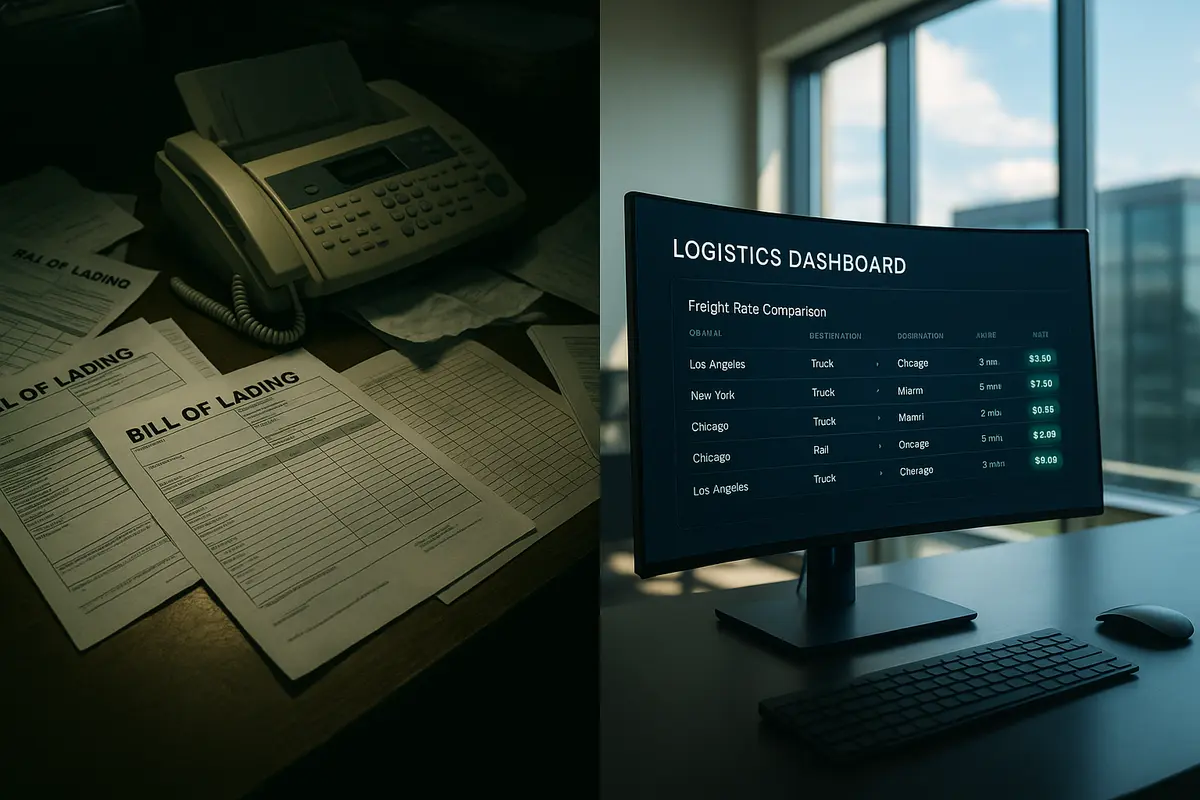

For shippers still running on spreadsheets, email chains, and phone calls, these numbers should trigger a serious conversation.

The Tipping Point Is Here

According to Global Trade Magazine, only 23% of freight forwarders have digitized at least 75% of their processes. That means the vast majority of the industry is still operating with manual workflows — and the gap between digital leaders and laggards is widening fast.

Cloud-based freight platforms now account for 71% of new deployments, according to Mordor Intelligence, because on-premise transportation management systems simply cannot connect to modern carrier APIs or provide the sub-minute visibility that shippers demand across modes.

The shift isn't gradual. It's a cliff. Companies that haven't started digitizing their freight operations are increasingly finding themselves locked out of competitive rates, faster booking cycles, and the compliance automation that modern trade demands.

EU CBAM: The Compliance Catalyst

The EU's Carbon Border Adjustment Mechanism (CBAM) entered full force on January 1, 2026, creating an entirely new layer of compliance for importers shipping goods into Europe. CBAM requires detailed carbon emissions reporting for covered goods — steel, aluminum, cement, fertilizers, electricity, and hydrogen — with certificates to be purchased starting February 2027.

For shippers managing this manually, the burden is enormous. Carbon data must be collected from suppliers across multiple tiers, verified against EU standards, and reported accurately. Miss the deadline or report incorrectly, and the financial penalties are significant.

This is where digital freight forwarding platforms earn their keep. Automated documentation workflows, integrated compliance checks, and carbon reporting modules turn what would be weeks of manual data gathering into a streamlined, auditable process. Shippers who digitized early are treating CBAM as a routine compliance step. Those who didn't are scrambling.

The Real Cost of Manual Processes

The financial impact of running freight operations manually goes far beyond the obvious labor costs. Here's what shippers lose when they stay analog:

Slower procurement cycles. Manual rate requests via email take days. Digital platforms deliver multi-carrier rate comparisons in minutes. In a volatile market where rates shift daily, speed translates directly to cost savings.

Missed rate opportunities. When ocean freight overcapacity pushes spot rates below contract rates — as we've seen throughout early 2026 — shippers need real-time visibility into rate movements. Manual tracking means you're always reacting to yesterday's market.

Compliance risk. Between CBAM, the EU's ICS2 advance cargo information requirements, and evolving cross-border documentation standards, the regulatory burden is growing exponentially. Manual compliance processes are error-prone and don't scale.

Limited visibility. Without digital integration, shipment tracking depends on phone calls and email updates from carriers. That's not visibility — it's guesswork with a lag.

Cross-border e-commerce is forecast to surpass $8 trillion by 2027 at a 9% CAGR, according to Mordor Intelligence. The shippers handling that volume cannot afford manual bottlenecks at any stage of the freight journey.

The Industry Giants Are Moving — Fast

Kuehne+Nagel, DHL, and other traditional logistics leaders are investing billions in digital transformation. They're embedding AI-driven dynamic pricing, API-enabled carrier connectivity, and automated customs clearance into their platforms. When the largest players in the industry are racing to digitize, mid-market shippers relying on phone calls and fax machines aren't just behind — they're becoming invisible to the carriers and partners building the future.

The EU's eFTI (electronic Freight Transport Information) digital documentation mandate is accelerating this further, with an impact timeline of two years or less according to industry analysis. Paper-based documentation is moving from "legacy" to "liability."

What Digital-First Shippers Get Right

The shippers winning in 2026 share common characteristics:

- Unified platform access — rate comparison, booking, documentation, and tracking in one place rather than five disconnected systems

- Real-time rate benchmarking — knowing whether a quoted rate is competitive before committing, not after

- Automated compliance — CBAM reporting, ICS2 declarations, and customs documentation generated from shipment data rather than manually assembled

- Multi-modal visibility — tracking ocean, air, and trucking legs through a single interface with real-time updates

- Data-driven decisions — historical shipment analytics that inform routing, carrier selection, and contract negotiations

These aren't luxury features. They're table stakes in a market growing at 25% annually.

Bridging the Gap with CXTMS

CXTMS was built for exactly this moment — when the logistics industry's digital transformation stops being optional. The platform delivers automated rate comparison across carriers and modes, integrated booking workflows, and documentation management that handles the complexity of cross-border compliance.

For shippers making the transition from manual processes, CXTMS offers a practical path forward: connect your existing carrier relationships, digitize your documentation workflows, and gain the visibility you need to compete in a market that's leaving paper-based operations behind.

The $50 billion question isn't whether digital freight forwarding will become the standard. It already is. The question is whether your organization will be part of that market — or disrupted by it.

Ready to digitize your freight operations? Contact CXTMS for a demo and see how automated rate comparison and compliance tools can transform your logistics.