Predictive Analytics for Freight Demand Forecasting: Why 2026 Is the Tipping Point

Freight demand doesn't care about your quarterly plan. Tariff shocks, weather disruptions, and shifting consumer behavior can render yesterday's forecast useless by morning. Yet most logistics teams still rely on spreadsheets and gut instinct to predict what's coming next. In 2026, that's no longer just inefficient — it's a competitive liability.

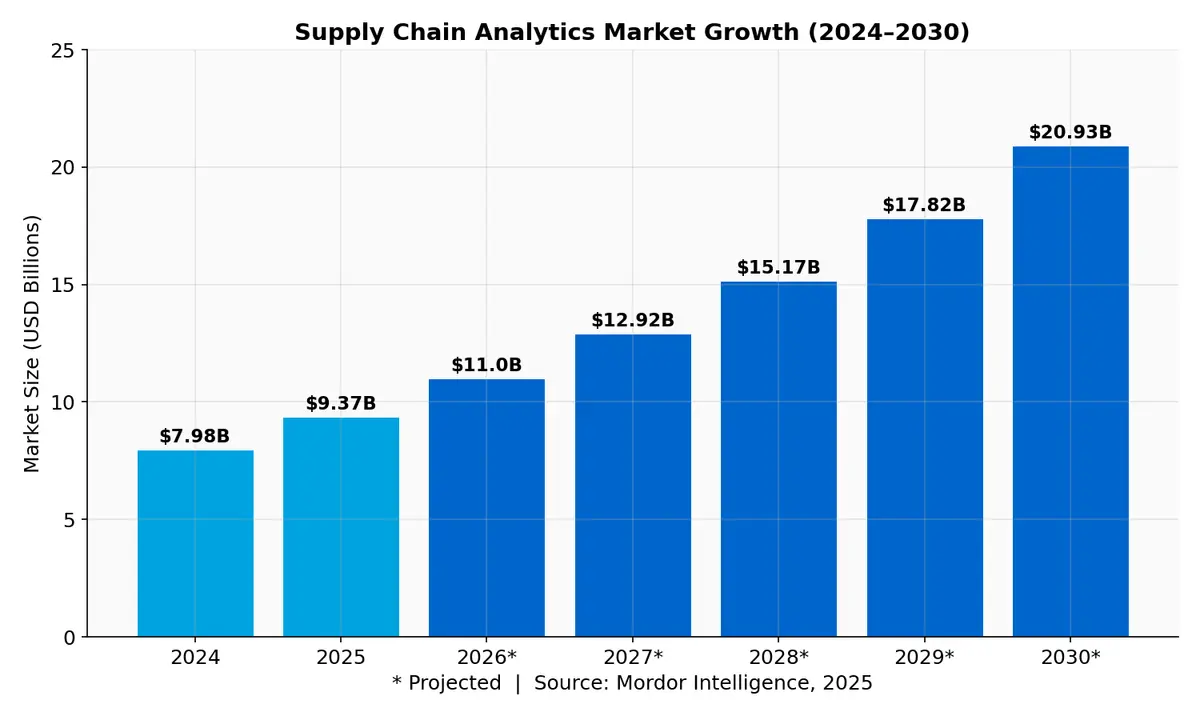

The $20 Billion Bet on Smarter Supply Chains

The supply chain analytics market tells a clear story: organizations are betting big on data-driven decision-making. According to Mordor Intelligence, the market is valued at $9.37 billion in 2025 and projected to reach $20.93 billion by 2030, growing at a 17.43% CAGR. Predictive analytics — the ability to forecast demand, anticipate disruptions, and optimize capacity before problems materialize — sits at the center of that growth.

What's driving the acceleration? Three converging forces: the explosion of real-time data from IoT sensors and GPS tracking, the maturation of machine learning models purpose-built for logistics, and the painful lessons of the post-pandemic supply chain crisis that exposed how fragile traditional forecasting really is.

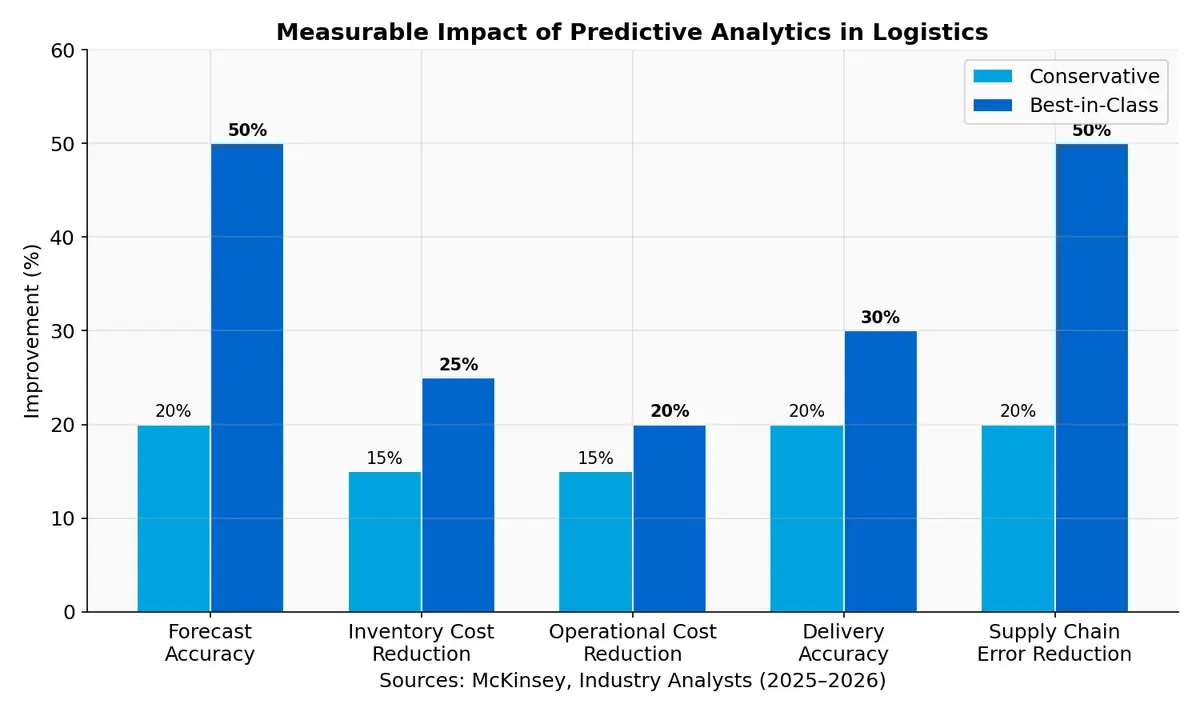

What Predictive Analytics Actually Delivers

Let's skip the buzzwords and look at what the numbers say. McKinsey reports that AI-driven forecasting reduces supply chain errors by 20 to 50 percent, translating to a 65% efficiency boost through fewer lost sales and stock-outs. Industry analysts confirm that companies leveraging predictive modeling achieve up to 20% operational cost reductions and 30% improvements in delivery accuracy.

Organizations that implement predictive analytics consistently report 20–50% forecast accuracy improvements and 15–25% inventory cost reductions, with measurable ROI within 6–12 months. These aren't theoretical projections — they're documented results from companies that replaced reactive planning with data-driven forecasting.

How Modern Freight Forecasting Works

Traditional demand forecasting uses historical shipment volumes and seasonal patterns — essentially looking backward to predict forward. Predictive analytics adds layers of intelligence:

Real-Time Signal Integration

Modern systems ingest data from dozens of sources simultaneously: port congestion levels, carrier capacity utilization, weather patterns, commodity prices, trade policy changes, and even social media sentiment that might signal demand shifts. A TMS with predictive capabilities processes these signals continuously, not in weekly planning meetings.

Machine Learning Pattern Recognition

Where humans see noise, ML models find patterns. Algorithms trained on years of freight data can identify correlations between seemingly unrelated variables — like how a specific weather pattern in Southeast Asia predicts container availability at West Coast ports three weeks later. These models improve over time, learning from every forecast they make.

Scenario Modeling

Rather than producing a single demand forecast, predictive systems generate probability-weighted scenarios. When tariff changes are announced, the system doesn't just flag the risk — it models the likely impact on shipping volumes, carrier rates, and lead times across your entire network, giving logistics teams time to act rather than react.

The Real-World Impact on Freight Operations

Predictive analytics transforms specific operational decisions that directly affect the bottom line:

Capacity planning becomes proactive. Instead of scrambling for spot market capacity during demand spikes, shippers can secure contract rates weeks in advance because they saw the spike coming. The difference between spot and contract rates during peak periods can exceed 40%.

Inventory positioning gets smarter. By forecasting regional demand patterns, companies pre-position inventory closer to where it will be needed, cutting transit times and transportation costs simultaneously. This is especially critical for perishable goods and time-sensitive shipments.

Carrier selection moves from reactive to strategic. Predictive models evaluate carrier performance patterns — not just on-time delivery rates, but how carriers perform under specific conditions like holiday surges, lane-specific congestion, or weather disruptions. This data-driven approach to carrier management consistently outperforms relationship-based selection.

Why Most Companies Still Struggle

Despite the clear ROI, adoption of predictive analytics in freight remains uneven. The barriers are real:

Data fragmentation is the biggest obstacle. Most shippers have shipment data spread across multiple TMS platforms, carrier portals, ERP systems, and spreadsheets. Without a unified data layer, predictive models lack the comprehensive input they need to generate reliable forecasts.

Talent gaps persist. Building and maintaining ML models requires data science expertise that most logistics organizations don't have in-house. The solution increasingly is platform-based — TMS vendors embedding predictive capabilities directly into operational workflows so logistics teams can benefit without becoming data scientists.

Integration complexity slows deployment. Predictive analytics delivers the most value when it's embedded in the systems where decisions are made — your TMS, your warehouse management system, your carrier management platform. Standalone analytics tools that produce insights nobody acts on are just expensive dashboards.

The 2026 Inflection Point

Three developments make 2026 the year predictive analytics moves from competitive advantage to table stakes:

-

AI supply chain spending is surging. Mordor Intelligence projects the AI supply chain market growing from $7.67 billion in 2025 to $35.28 billion by 2030 — a 35.67% CAGR. That investment is making predictive tools more accessible and affordable.

-

Data standardization is accelerating. Initiatives like EPCIS 2.0 and API-first TMS platforms are solving the data fragmentation problem, giving predictive models the clean, comprehensive datasets they need.

-

Disruption frequency isn't decreasing. Trade wars, climate events, and geopolitical instability make reactive logistics planning increasingly untenable. Companies that can't anticipate disruptions will lose to those that can.

Getting Started Without Boiling the Ocean

You don't need a data science team or a seven-figure analytics platform to start. The practical path forward:

- Start with one lane or one customer. Pick your highest-volume freight lane and build a demand forecast using your existing shipment history. Even basic time-series analysis beats gut instinct.

- Choose a TMS with built-in analytics. Modern platforms embed predictive capabilities directly into operational workflows, eliminating the integration challenge.

- Measure forecast accuracy religiously. Track your predictions against actual demand weekly. This creates the feedback loop that makes forecasting better over time.

- Layer in external data gradually. Once your baseline forecast works, add weather data, carrier capacity signals, and market indicators one at a time.

The Bottom Line

The supply chain analytics market is growing at 17% annually for a reason: predictive analytics works. Companies that forecast freight demand accurately ship faster, spend less, and absorb disruptions that cripple their competitors. The question isn't whether predictive analytics belongs in your logistics operation — it's how quickly you can get it there.

Ready to bring predictive intelligence to your freight operations? Contact CXTMS for a demo of our analytics-powered TMS platform.