Freight Commodity Classification Demystified: How NMFC Codes and AI Are Transforming LTL Pricing in 2026

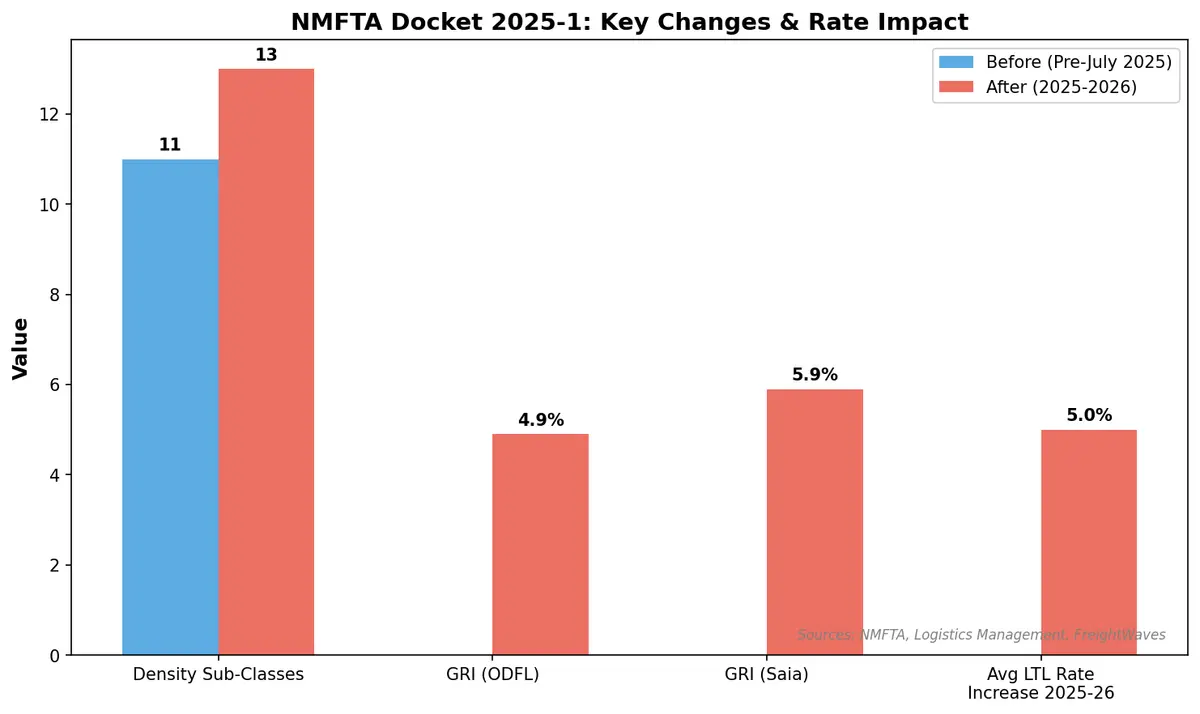

If you've ever shipped less-than-truckload (LTL) freight and been hit with an unexpected reclassification surcharge, you already know the pain of commodity classification gone wrong. In a $53 billion LTL market where carriers implemented 4.9–5.9% general rate increases heading into 2026, getting your freight class right isn't just administrative housekeeping — it's a direct lever on your bottom line.

What Is Commodity Classification in Shipping?

In freight shipping, a "commodity" is simply the type of goods being transported. Commodity classification is the process of assigning a standardized code to those goods that determines how they'll be rated and priced by LTL carriers.

The system that governs this in the United States is the National Motor Freight Classification (NMFC), maintained by the National Motor Freight Traffic Association (NMFTA). Every product that moves through an LTL network — from machine parts to mattresses — gets assigned an NMFC item number and a corresponding freight class.

Think of it as the freight industry's universal language for pricing. Without it, every carrier would rate goods differently, making comparison shopping impossible and billing disputes inevitable.

The 18 NMFC Freight Classes Explained

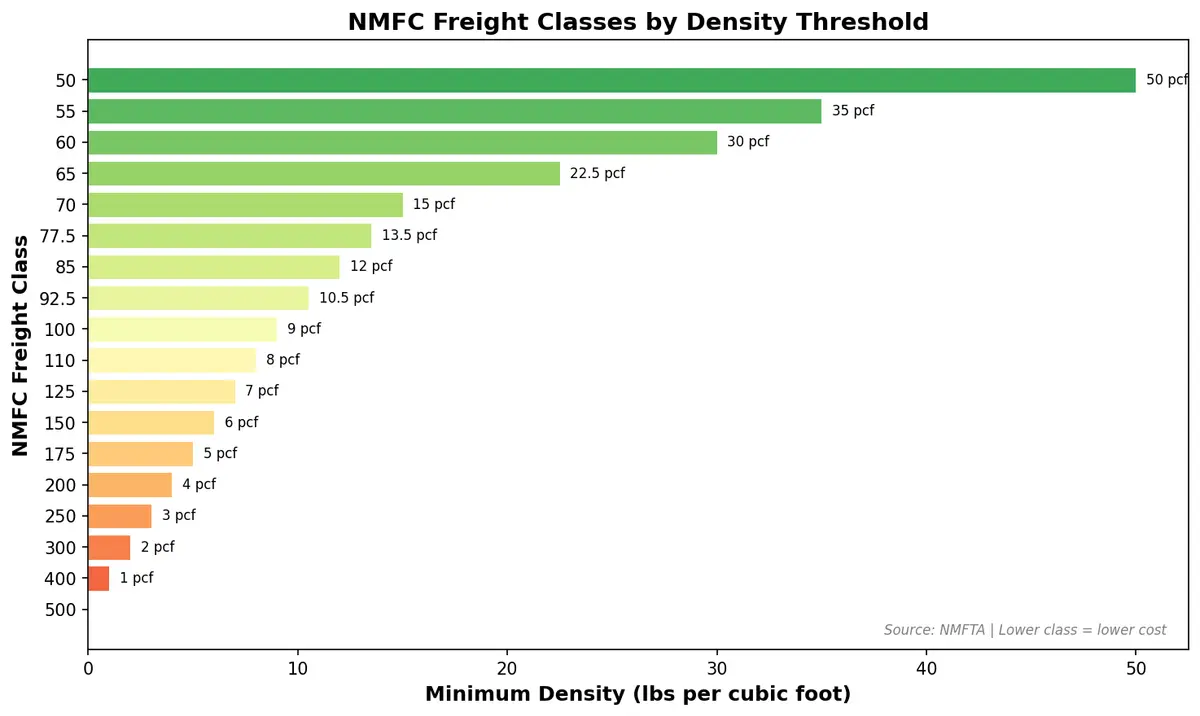

NMFC freight classes range from Class 50 (the cheapest to ship) to Class 500 (the most expensive). The class assignment has historically been based on four factors:

- Density — weight per cubic foot (the dominant factor)

- Stowability — how easily the freight fits with other shipments

- Handling — special equipment or care requirements

- Liability — value and fragility of the goods

Higher-density, easy-to-handle, low-risk freight gets a lower class and lower rates. A pallet of bricks (Class 50) costs far less to ship per pound than a pallet of ping pong balls (Class 400) because the bricks are dense, stackable, and durable.

The 2025 Reclassification: The Biggest NMFC Overhaul in Decades

On July 19, 2025, NMFTA implemented Docket 2025-1 — one of the largest reclassifications in the system's history. The changes fundamentally shifted how freight classes are assigned:

From 11 to 13 density sub-classes. The old 11-sub density scale was replaced with a more granular 13-sub density scale, giving carriers and shippers finer resolution on pricing. This means fewer commodities get lumped into the same bracket, and rates more accurately reflect actual shipping characteristics.

Density-first classification. While the four traditional factors still exist, the update pushes the system even further toward a density-based model. According to FreightWaves, the simplification aims to reduce complexity and improve rate accuracy across the board.

Updated item language. Thousands of NMFC item descriptions were revised, with many commodities reclassified into different tiers. For shippers who hadn't updated their systems, the result was immediate: mismatched classes, carrier reclassification fees, and billing disputes.

Why Classification Errors Are So Costly

Misclassification is one of the most common — and most expensive — problems in LTL shipping. When a shipper assigns the wrong freight class on a bill of lading, the carrier can:

- Reclassify the shipment after inspection, adjusting charges upward

- Apply reweigh fees if the declared weight doesn't match

- Add accessorial charges for handling discrepancies

According to industry data from Logistics Management, LTL carriers are maintaining strict pricing discipline in 2026 despite soft demand — meaning they have zero appetite for absorbing shipper classification errors. With carriers like Old Dominion leading 4.9% GRIs and Saia implementing 5.9% increases, every percentage point of misclassification waste compounds.

For mid-size shippers moving 50–200 LTL shipments per week, classification errors can add up to 5–10% in avoidable freight spend annually — tens or hundreds of thousands of dollars walking out the door.

How AI Auto-Classification Is Changing the Game

The complexity of 18 freight classes across tens of thousands of NMFC items is exactly the kind of problem AI was built to solve. A new generation of AI-powered classification tools is emerging that can:

Auto-classify from product data. Feed in a product description, dimensions, and weight, and the system returns the correct NMFC code and freight class — no memorization of commodity codes required.

Dimensioning integration. Computer vision systems mounted on warehouse docks capture precise dimensions and weight in real time, calculating density automatically. As C.H. Robinson noted, "with machines providing precise measurements, there are fewer disputes, which prevents unexpected cost adjustments."

Continuous learning from carrier feedback. When carriers reclassify a shipment, AI systems log the correction and update their models, steadily reducing error rates over time.

Pre-audit billing. AI tools compare the classification on each invoice against the actual shipment profile, flagging discrepancies before payment — turning reactive disputes into proactive savings.

Five Steps to Get Your Classification Right in 2026

Whether you're adopting AI tools or tightening manual processes, here's how to stay ahead of the new NMFC landscape:

-

Invest in dimensioning equipment. Pallet dimensioners pay for themselves quickly by eliminating guesswork on density — the primary factor in classification.

-

Update your TMS commodity database. If your system still references pre-July 2025 NMFC codes, you're shipping on outdated classifications. Update immediately.

-

Train your dock staff. The people filling out bills of lading need to understand the new 13-sub density scale and how it affects class assignments.

-

Audit your freight invoices monthly. Look for patterns in reclassification charges — they reveal systematic classification errors you can fix at the source.

-

Leverage AI classification in your TMS. Modern platforms can auto-assign NMFC codes at the point of booking, validate against carrier rules, and flag anomalies before the shipment leaves your dock.

How CXTMS Automates Freight Classification

CXTMS takes the pain out of commodity classification with built-in automation:

- Smart commodity matching assigns the correct NMFC code based on product attributes, dimensions, and historical shipment data

- Real-time density calculation integrates with warehouse dimensioning systems to ensure accurate class assignment at booking

- Carrier rate validation cross-checks classifications against each carrier's tariff rules before tendering, preventing reclassification surprises

- Invoice audit workflows automatically flag classification discrepancies between booked and billed freight classes

In an LTL market where carriers are holding firm on rates and enforcing strict classification standards, the shippers who automate their freight classification will be the ones who protect their margins.

Tired of reclassification surprises eating into your freight budget? Contact CXTMS for a demo and see how automated commodity classification can cut your LTL costs.