Is an Automated Parcel Audit Worth It for Mid-Size Shippers? A Data-Driven Answer

Mid-size shippers — those spending between $500,000 and $10 million annually on parcel shipping — sit in an uncomfortable middle ground. They're shipping enough volume for billing errors to add up fast, but not always enough to justify a dedicated audit team. The question isn't whether errors exist. It's whether the cost of catching them automatically pays for itself.

The Billing Error Problem No One Talks About

Carrier invoices aren't as accurate as most shippers assume. According to industry analysis from Transportation Insight, most shippers can recover 1 to 5 percent of total freight spend through proper audit and resolution. The errors come from accessorial charges, misapplied discounts, duplicate billing, incorrect dimensional weight calculations, and late delivery refunds that carriers never voluntarily issue.

For a mid-size shipper spending $2 million annually on parcel, that's $20,000 to $100,000 sitting on the table — every single year.

The 2026 rate environment makes this worse. UPS and FedEx both implemented general rate increases averaging 5.9 percent for 2026, but the real impact runs higher for many shippers once you factor in surcharge adjustments, dimensional weight changes, and peak season layers. More rate complexity means more opportunities for billing discrepancies.

Manual Audit vs. Automated: The Real Cost Comparison

Manual parcel auditing — assigning staff to spot-check invoices against contracts — catches some errors but misses most. A typical manual process reviews maybe 10 to 15 percent of invoices and relies on humans spotting discrepancies across dozens of surcharge categories, accessorial codes, and contract-specific discount tiers.

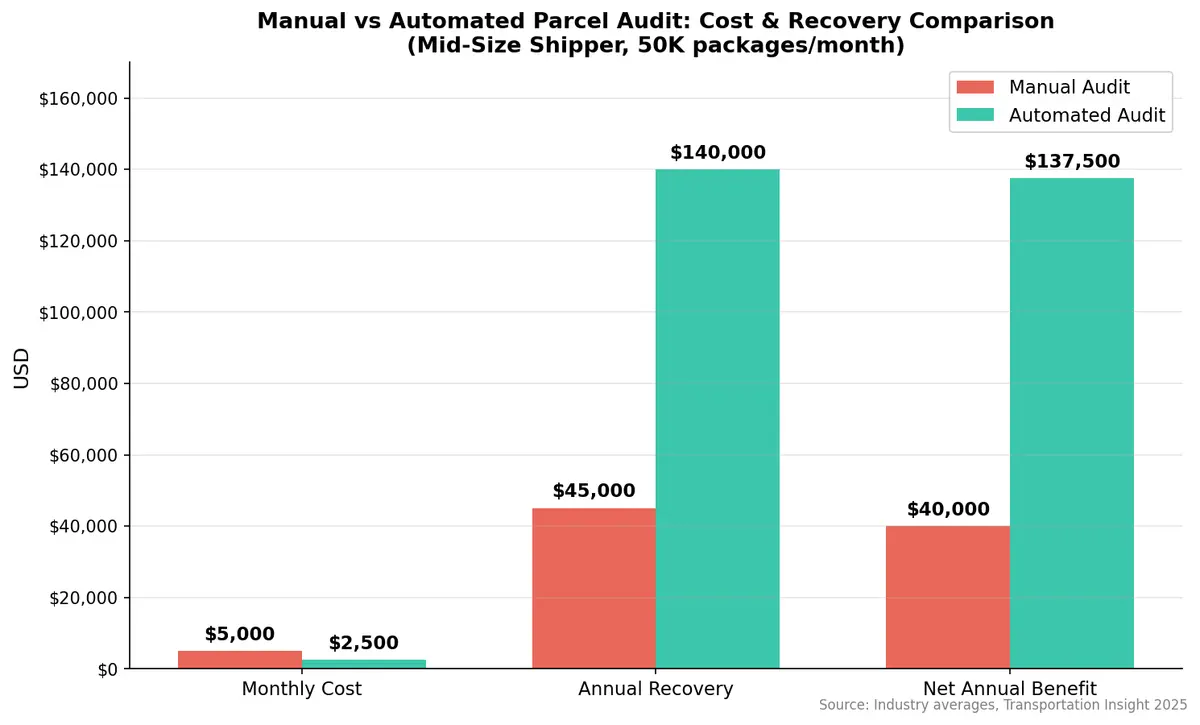

Here's how the numbers break down for a shipper processing 50,000 packages per month:

Manual audit costs roughly $4,000–$6,000 monthly in labor (one dedicated analyst), catches an estimated 15–25 percent of billing errors, and typically recovers $30,000–$60,000 annually.

Automated audit platforms cost $1,500–$3,500 monthly (or a percentage of recoveries), catch 85–95 percent of errors by checking every invoice against every contract term, and typically recover $80,000–$200,000 annually for the same volume.

The math is straightforward: automated audit systems pay for themselves within the first month for most mid-size shippers.

Where the Money Hides: Common Error Categories

Automated systems excel because they check every shipment against more than 150 service points. As FreightWaves reported, modern audit platforms review overcharges from late shipments, duplicate billing, loss and damage claims, manifested-not-shipped packages, and address corrections — regardless of dollar amount.

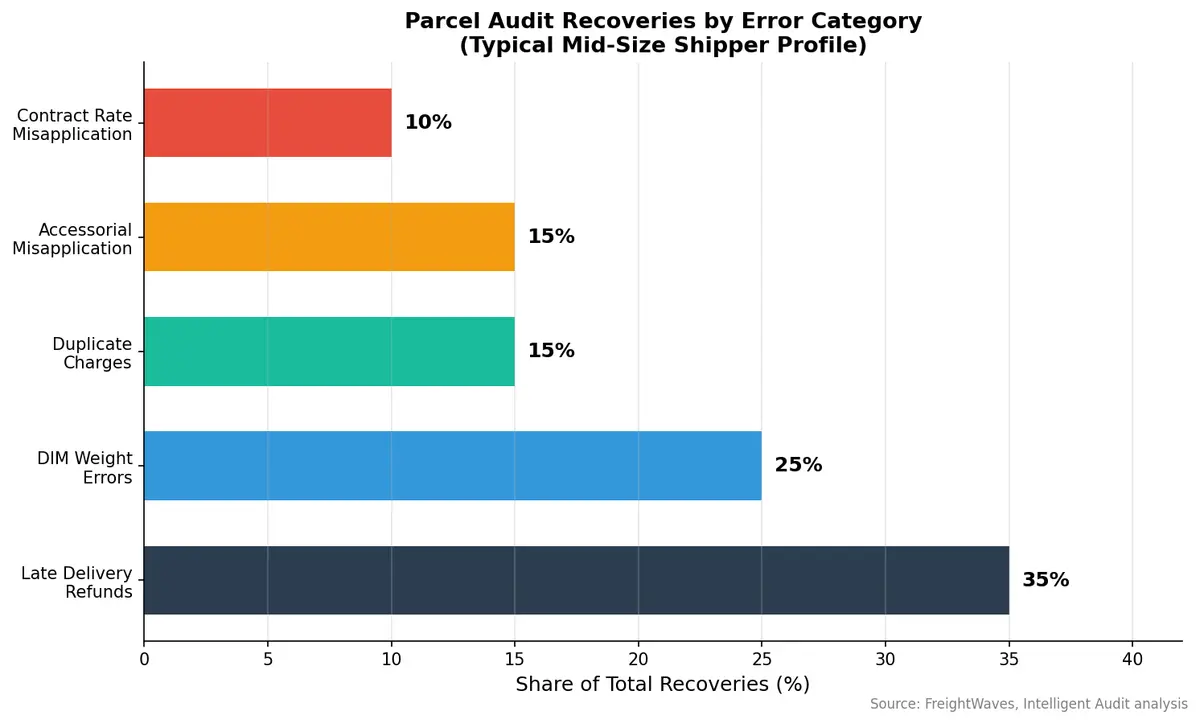

The biggest recovery categories for mid-size shippers include:

- Late delivery refunds (service failures): Carriers guarantee delivery times but don't automatically credit you when they miss them. This alone can represent 2–5 percent of spend for ground and express shipments.

- Duplicate charges: More common than expected, especially during carrier system migrations and peak season processing.

- Incorrect dimensional weight: DIM weight pricing errors increase as carriers tighten thresholds. The 2026 DIM divisor adjustments make this category larger than ever.

- Accessorial misapplication: Residential surcharges on commercial addresses, incorrect delivery area surcharges, and wrong additional handling fees.

- Contract rate misapplication: Negotiated discounts that don't get applied, tier thresholds miscalculated, or incentive rebates missed entirely.

The Freight Audit Market Is Growing for a Reason

The freight audit and payment market is projected to reach $691 million by 2031, growing at a 13.67 percent CAGR, according to Verified Market Research. That growth reflects a simple reality: as shipping costs rise and rate structures get more complex, the ROI on automated audit only increases.

AI and machine learning are accelerating this shift. Modern platforms don't just match invoices against contracts — they identify patterns across thousands of shipments, flag anomalies that rule-based systems miss, and predict which lanes and service types are most likely to generate billing errors. As Mordor Intelligence notes, AI-powered freight audit solutions now offer predictive analytics that help shippers negotiate better rates based on historical error patterns.

When to Invest — and When to Wait

Invest now if:

- You ship more than 5,000 parcels monthly

- Your annual parcel spend exceeds $500,000

- You have negotiated carrier contracts with custom pricing tiers

- You use multiple carriers (UPS, FedEx, regional carriers)

- You haven't audited invoices in the past 12 months

Consider waiting if:

- Your monthly volume is under 1,000 packages

- You ship on standard published rates with no contract

- You use a single carrier with simple pricing

For shippers on the fence, many audit platforms operate on a contingency model — they take a percentage (typically 25–50 percent) of recovered funds. No recoveries, no cost. This eliminates the risk of investing in a solution that doesn't deliver.

What to Look for in a Parcel Audit Platform

Not all audit solutions are created equal. Mid-size shippers should prioritize:

- Full invoice coverage — The platform should audit 100 percent of invoices, not just samples.

- Multi-carrier support — UPS, FedEx, USPS, DHL, and regional carriers all under one roof.

- Automated claims filing — Identifying errors is only half the battle. The system should file refund claims automatically.

- Contract compliance monitoring — Beyond billing errors, track whether you're hitting volume thresholds for negotiated tier pricing.

- Spend analytics — The best platforms turn audit data into actionable insights for contract renegotiation.

The Bottom Line

For mid-size shippers, automated parcel audit isn't a nice-to-have — it's a cost-recovery engine with provable ROI. The combination of rising rates, increasing surcharge complexity, and AI-powered audit capabilities makes 2026 the year where the question shifts from "is it worth it?" to "how much are we leaving on the table without it?"

The data is clear: shippers who audit recover money. Shippers who automate that audit recover significantly more.

Struggling to keep up with parcel billing complexity? Contact CXTMS for a demo of our freight audit and cost optimization capabilities.