The Freight Management Software Market Hits $21.6 Billion: Why Shippers Can't Afford to Wait

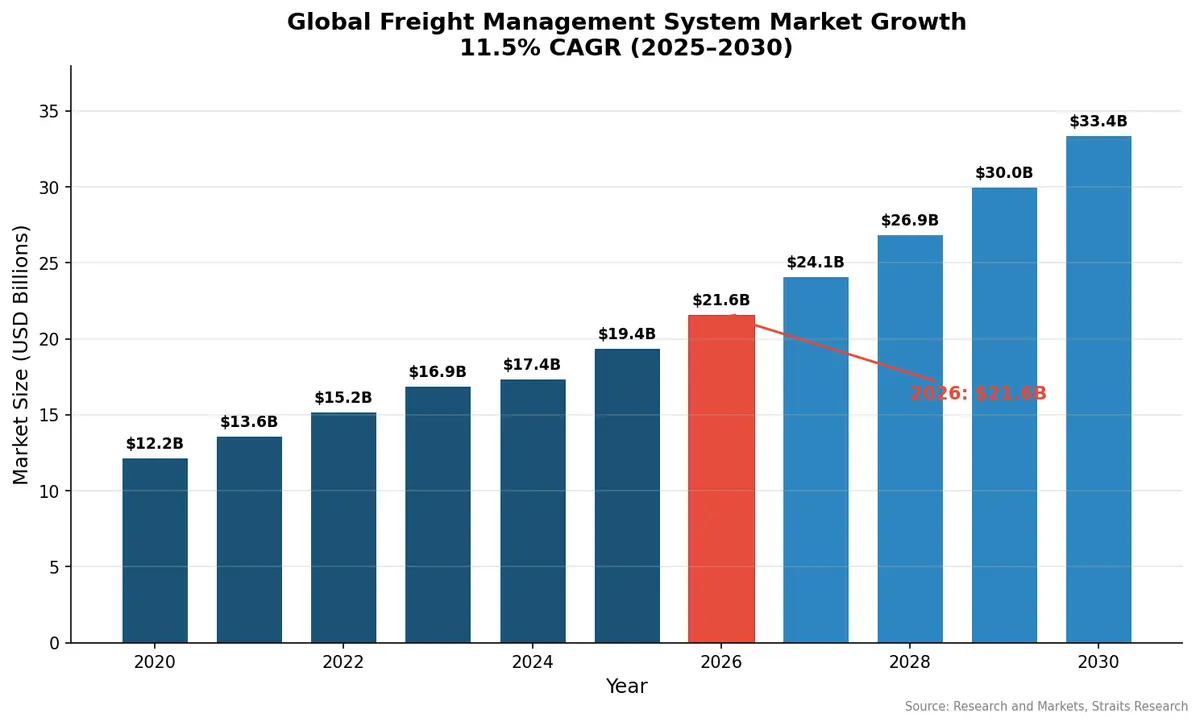

The global freight management system market has hit $21.6 billion in 2026, up from $19.4 billion just a year ago. That 11.5% compound annual growth rate isn't slowing down — and the shippers still managing freight with spreadsheets and phone calls are watching their margins disappear in real time.

A Market That's Accelerating, Not Plateauing

According to Research and Markets, the freight management system market grew from $19.41 billion in 2025 to $21.64 billion in 2026 — an 11.5% year-over-year jump driven by surging global freight volumes, increasingly complex supply chains, and the rapid adoption of AI-native logistics platforms.

Straits Research projects the market will continue this trajectory well into the next decade, with North America commanding over 35% of global market share.

This isn't a bubble. It's a structural shift. As e-commerce volumes continue climbing and supply chains grow more fragmented across borders, the complexity of managing freight manually has crossed a breaking point.

What's Driving the $21.6 Billion Surge

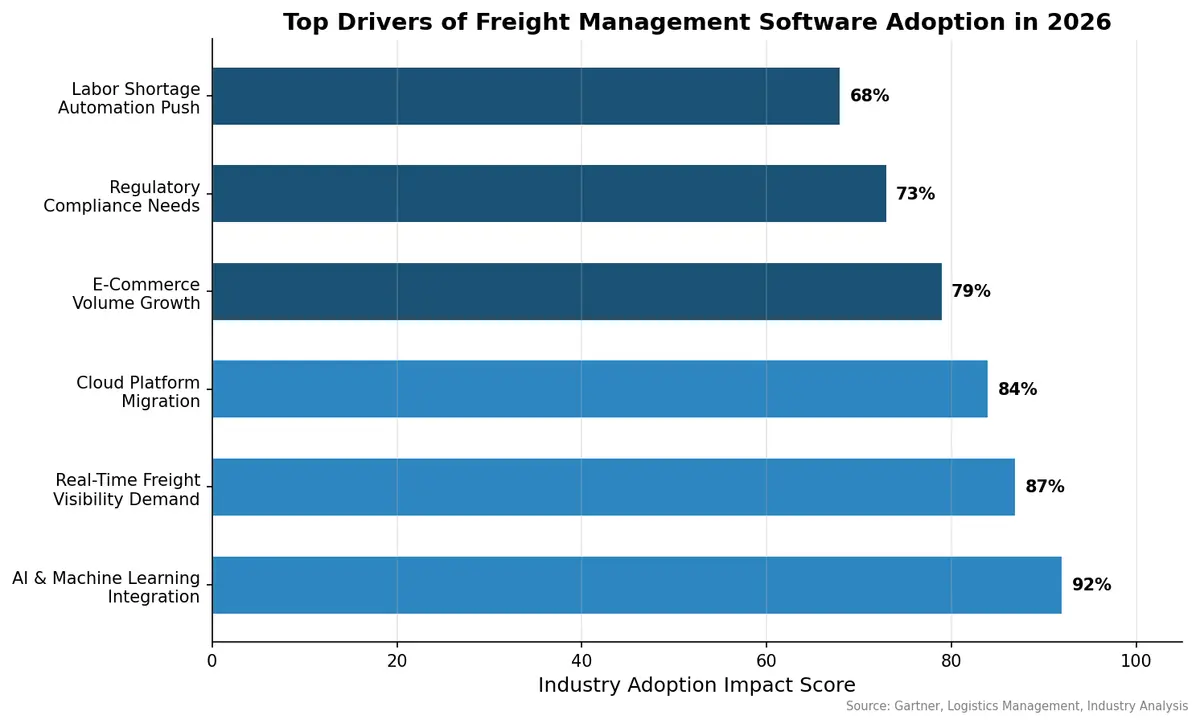

Three forces are converging to push freight management software from "nice to have" to "operational necessity."

1. AI Is Rewriting the Rules

Gartner's 2025 supply chain technology trends report identified agentic AI, ambient intelligence, and augmented workforces as the top forces reshaping logistics. Modern TMS platforms now use AI to evaluate routing alternatives during disruptions, predict carrier performance, and automate freight audit — capabilities that simply don't exist in manual workflows.

According to Logistics Management, AI-powered TMS platforms are moving beyond basic optimization to full workflow automation — from booking to billing.

2. Cloud Migration Is Accelerating

The shift from on-premise legacy systems to cloud-native platforms has reached a tipping point. Cloud TMS solutions offer faster deployment, lower upfront costs, and the scalability that mid-market shippers need to compete with enterprise players. Organizations that once spent 12–18 months on TMS implementations now go live in weeks.

3. Freight Complexity Has Outgrown Manual Processes

The average shipper today manages relationships with dozens of carriers across multiple modes — LTL, FTL, ocean, air, parcel. Manual rate shopping, paper-based documentation, and reactive exception management simply can't keep pace. Industry analysis shows that 3–5% of freight invoices contain billing errors, and shippers without automated audit tools leave millions on the table annually.

The Cost of Waiting

Every quarter a shipper delays TMS adoption, the gap widens. Here's what manual freight management actually costs:

- Freight spend leakage: Without automated rate comparison and carrier optimization, shippers overpay by 8–15% on average

- Labor inefficiency: Manual booking, tracking, and invoicing consume 3–5x the labor hours of automated workflows

- Visibility gaps: When disruptions hit, shippers without real-time tracking lose days to reactive firefighting instead of proactive rerouting

- Audit failures: That 3–5% invoice error rate compounds across thousands of shipments per year — often six or seven figures in unrecovered overcharges

As Supply Chain Brain reports, proving TMS ROI has become straightforward: historical lane data analysis alone typically reveals enough carrier underutilization and overcharging to justify implementation costs within the first year.

Cloud-Native vs. Legacy: The Divide Is Growing

The freight management software market isn't growing evenly. Cloud-native, AI-first platforms are capturing the lion's share of new deployments, while legacy on-premise systems struggle with integration complexity and slow innovation cycles.

Modern platforms offer:

- API-first architecture that connects carriers, ERPs, and warehouse systems without custom middleware

- Real-time optimization that continuously adjusts routing based on live market rates and capacity

- Embedded analytics that surface actionable insights without exporting data to separate BI tools

- Multi-modal support across truck, ocean, air, and parcel in a single interface

Legacy systems, by contrast, often require months of customization, dedicated IT resources, and expensive upgrade cycles that leave shippers perpetually behind the technology curve.

What Smart Shippers Are Doing Now

The shippers gaining ground in 2026 share a common playbook:

- Starting with visibility. Real-time shipment tracking across all modes and carriers creates the foundation for everything else

- Automating freight audit. AI-powered invoice validation catches errors at scale and recovers costs that fund further technology investment

- Consolidating carrier management. A single platform for rate shopping, booking, and performance tracking eliminates the tool sprawl that plagues most logistics teams

- Leveraging predictive analytics. Demand forecasting and capacity planning reduce emergency shipments and spot market exposure

The Bottom Line

At $21.6 billion and growing at 11.5% annually, the freight management software market is sending a clear signal: digital freight management has become table stakes. The question isn't whether to adopt a modern TMS — it's how quickly you can get one deployed before the competitive gap becomes insurmountable.

The shippers who moved early are already seeing 8–15% freight cost reductions, 60–70% less time spent on manual processes, and dramatically fewer billing errors. The ones still waiting are funding those savings with their own inefficiency.

Ready to see what a modern, AI-native TMS can do for your freight operations? Contact CXTMS for a personalized demo.