The Complete Guide to Transportation Management Systems: Why TMS Is No Longer Optional in 2026

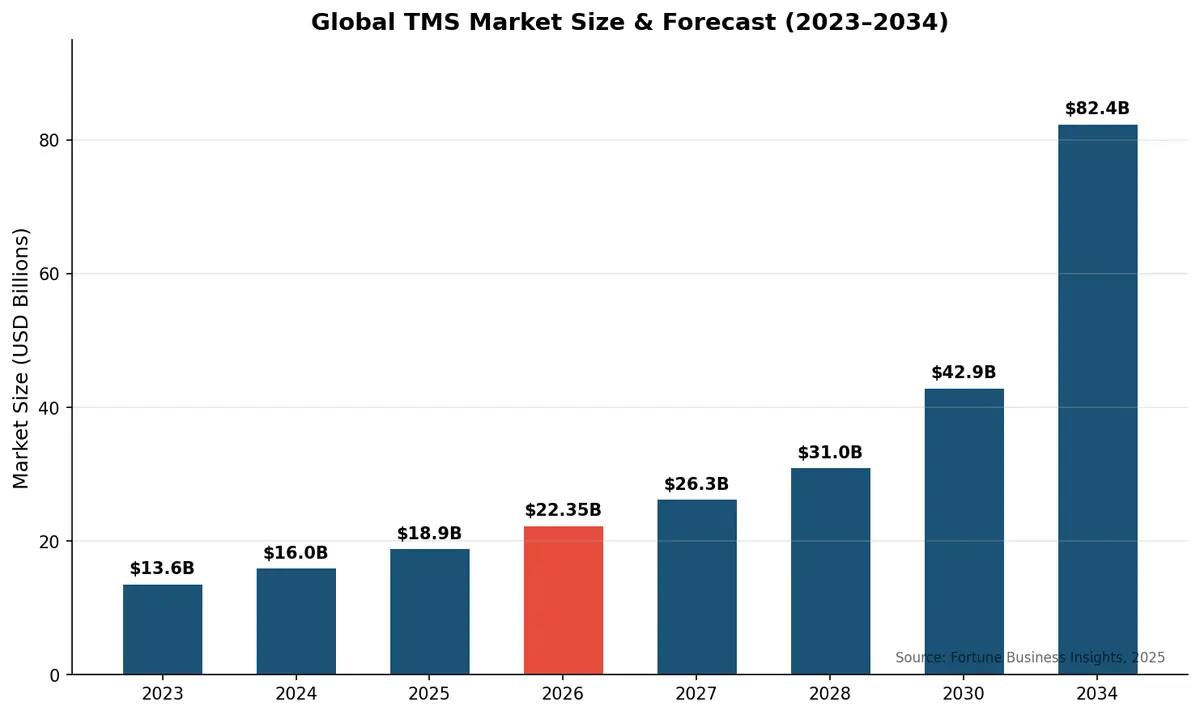

The global TMS market is projected to reach $22.35 billion in 2026 and rocket to $82.4 billion by 2034 at a 17.7% CAGR, according to Fortune Business Insights. But behind those headline numbers lies a practical question every logistics leader faces: what exactly should a modern TMS do, and how do you pick the right one?

This guide cuts through the noise. Whether you're replacing a legacy system or implementing your first TMS, here's what actually matters in 2026.

What a TMS Actually Does (and Doesn't Do)

A transportation management system orchestrates the movement of goods from origin to destination. At its core, it handles four functions: planning (mode selection, route optimization, carrier matching), execution (tendering, booking, tracking), settlement (freight audit, payment, cost allocation), and analytics (performance reporting, spend visibility, forecasting).

What a TMS doesn't do — at least not well on its own — is manage warehouse operations, handle customs brokerage end-to-end, or replace your ERP. The best TMS platforms integrate tightly with WMS, ERP, and customs systems rather than trying to absorb them.

The Market in 2026: Three Shifts Reshaping TMS

1. Cloud Has Won

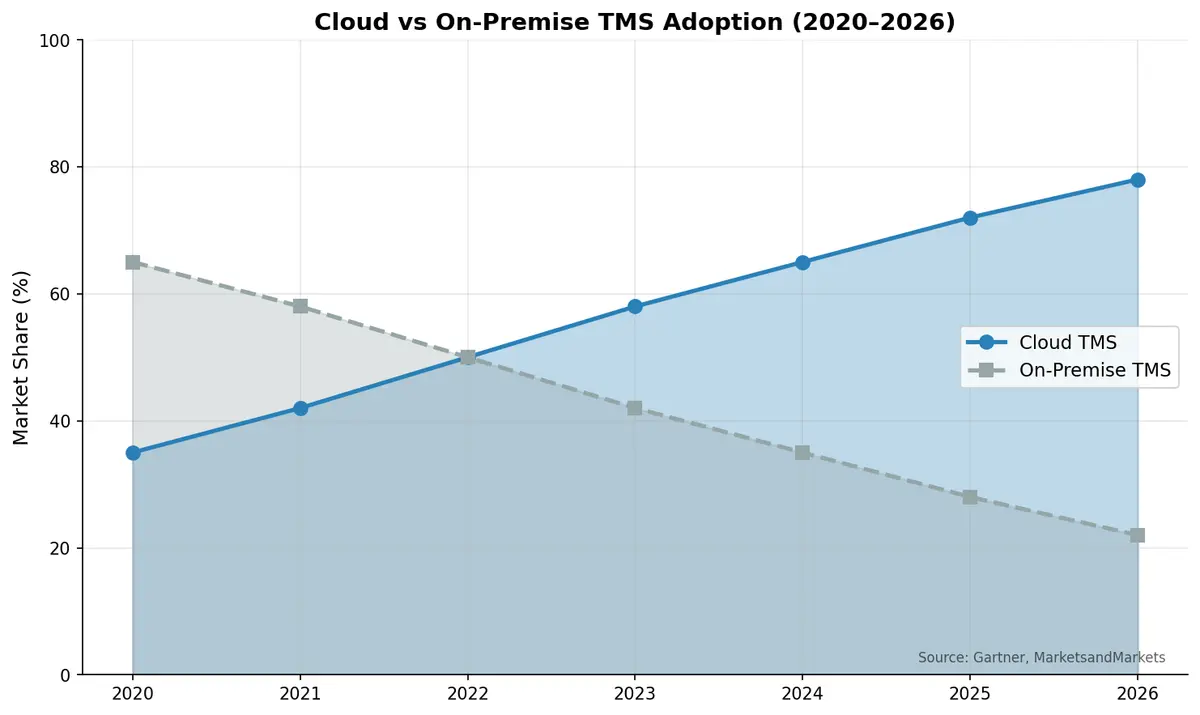

The cloud vs on-premise debate is effectively over. Cloud-based TMS deployments now account for roughly 78% of new implementations, up from just 35% in 2020, according to Gartner's latest TMS market analysis. The reasons are straightforward: faster deployment (weeks vs months), lower upfront costs, automatic updates, and the ability to scale capacity during peak seasons without hardware investments.

On-premise still makes sense for organizations with strict data sovereignty requirements or highly customized legacy workflows. But for the majority of shippers, cloud is the default.

2. AI Is Becoming Table Stakes

Every TMS vendor now advertises AI capabilities, but the maturity varies enormously. The features that deliver real value today include:

- Predictive ETAs that account for weather, port congestion, and carrier performance history

- Dynamic carrier scoring that adjusts recommendations based on real-time reliability data

- Automated freight audit that catches billing errors across thousands of invoices — the industry average error rate sits between 3% and 5% of total freight spend

- Demand-responsive routing that adjusts plans as order patterns shift

The features that are still more marketing than reality: fully autonomous freight procurement, self-healing supply chains, and "agentic" TMS that operates without human oversight.

3. Multi-Modal Is No Longer Optional

Global supply chains don't respect modal boundaries. A shipment might start as ocean freight, transfer to rail, then finish as LTL. Modern TMS platforms must handle this seamlessly — planning across modes, optimizing total landed cost rather than individual leg costs, and maintaining visibility through every handoff.

The ROI Case: What to Actually Expect

The question every CFO asks: what's the payback? Here's what the data shows.

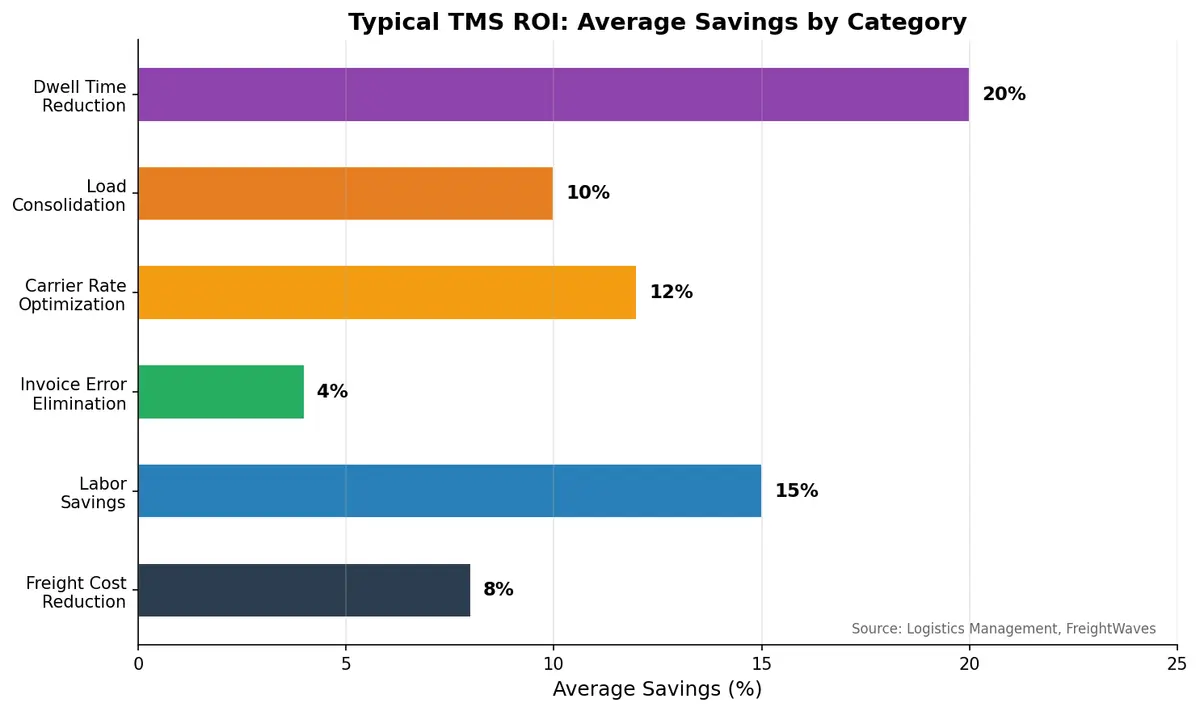

A well-implemented TMS typically delivers 5–10% savings on total freight spend within the first year, according to Logistics Management's analysis of TMS cost impact. For a company spending $50 million annually on freight, that's $2.5 to $5 million back in your pocket.

The savings come from multiple angles: better carrier rate negotiation through benchmarking data, load consolidation that reduces shipment volume by 10–15%, automated invoice auditing that eliminates the 3–5% error rate, and route optimization that cuts transit times and fuel costs.

But here's what vendors won't tell you: implementation costs and time are the real variable. Cloud TMS deployments typically take 8–16 weeks for basic functionality, while complex multi-modal implementations can stretch to 6 months. Factor in change management, training, and the productivity dip during transition. Most organizations see full ROI within 12–18 months.

The 8-Point TMS Selection Checklist

After analyzing dozens of TMS implementations, here are the criteria that separate good decisions from expensive regrets:

1. Carrier Network Breadth. How many carriers are pre-integrated? A TMS with 50,000+ carrier connections saves months of onboarding compared to building integrations from scratch.

2. API-First Architecture. Your TMS must integrate with your ERP, WMS, order management system, and potentially dozens of other tools. Look for RESTful APIs with clear documentation, not proprietary connectors that lock you in.

3. Real-Time Visibility. Track-and-trace across all modes, with automated exception alerts. Your customers expect it; your operations team needs it.

4. Freight Audit Automation. Manual audit processes catch only a fraction of billing errors. AI-powered audit should be a baseline feature, not a premium add-on.

5. Scalability Under Load. Ask about peak season performance. A TMS that handles 1,000 shipments per day needs to handle 5,000 during holiday surges without degradation.

6. Analytics and Reporting. Dashboards are nice; actionable insights are better. Look for spend analytics, carrier scorecards, lane analysis, and the ability to export data for your own BI tools.

7. Multi-Modal Support. If you ship across ocean, air, rail, and truck — or plan to — your TMS must support all modes natively, not through bolted-on modules.

8. Total Cost of Ownership. SaaS pricing looks clean until you add implementation fees, per-transaction charges, integration costs, and premium support tiers. Get the full picture before signing.

Why 2026 Is the Tipping Point

Three converging forces make TMS adoption urgent this year. First, regulatory pressure: the EU's Corporate Sustainability Reporting Directive now requires Scope 3 emissions reporting, and transportation is the largest contributor to most companies' supply chain carbon footprint. A TMS with carbon tracking isn't a nice-to-have — it's a compliance requirement.

Second, customer expectations: same-day and next-day delivery have moved from e-commerce luxury to B2B standard. Meeting those windows without a TMS means throwing money at expedited shipping.

Third, competitive pressure: with the TMS market growing at nearly 18% annually, your competitors are investing. The efficiency gap between companies with modern TMS and those running on spreadsheets and phone calls widens every quarter.

Choosing a TMS Built for What's Next

The best TMS platforms aren't just digitizing existing processes — they're enabling new capabilities. AI-native architecture, real-time carrier collaboration, embedded sustainability tracking, and seamless multi-modal planning define the next generation.

CXTMS was built from the ground up as a cloud-native, AI-powered transportation management platform designed for the complexity of modern global logistics. From multi-modal visibility to automated freight audit, it delivers the features outlined in this guide without the legacy baggage.

Ready to see what a modern TMS can do for your operation? Request a CXTMS demo and discover how AI-native freight management cuts costs while improving service levels.