Reverse Logistics in 2026: Why Returns Management Is the New Competitive Battlefield

With retail returns projected to hit $849.9 billion in 2025 — representing 15.8% of all retail sales according to the National Retail Federation — the way companies handle returns is no longer a back-office afterthought. It's a front-line competitive weapon.

The reverse logistics market itself surpassed $872.6 billion in 2025 and is growing at a 7.3% CAGR through 2035. But raw market size doesn't tell the real story. What's changed in 2026 is who wins — and the winners aren't the companies trying to eliminate returns. They're the ones mastering the value cycle.

The Returns Battlefield Has Shifted

For years, retailers treated returns as pure loss: ship it back, inspect it, restock it, write it off. That playbook is dead.

DHL's January 2026 research makes the case bluntly: the winners in global commerce are those mastering the value cycle, not those trying to eliminate returns entirely. Meanwhile, carriers like FedEx have launched box-free, label-free return programs that turn the returns experience itself into a brand touchpoint.

The strategic shift breaks down into three battlefronts: speed, recovery, and sustainability.

Battlefront 1: Speed of Disposition

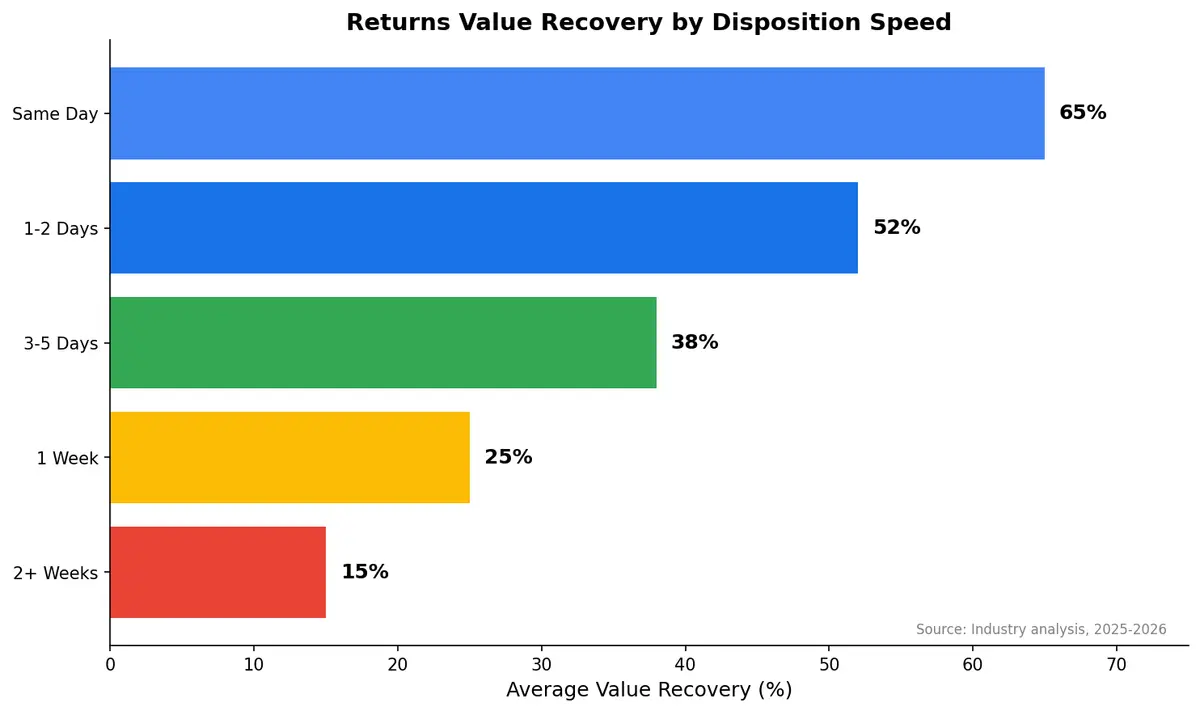

The clock starts the moment a customer initiates a return. Every day a returned item sits in limbo, it loses value — electronics depreciate fastest, but even apparel loses 20–30% of resale value within weeks of a season change.

Leading operations now sort returned inventory within 24–48 hours using AI-powered disposition engines. These systems evaluate the item's condition, current demand, and optimal channel (restock, refurbish, liquidate, or recycle) without human intervention for 60–70% of items.

The payoff is direct: faster disposition means higher recovery rates. Companies that cut their returns processing time from two weeks to two days routinely recover 15–25% more value per returned unit.

Battlefront 2: Recommerce and Value Recovery

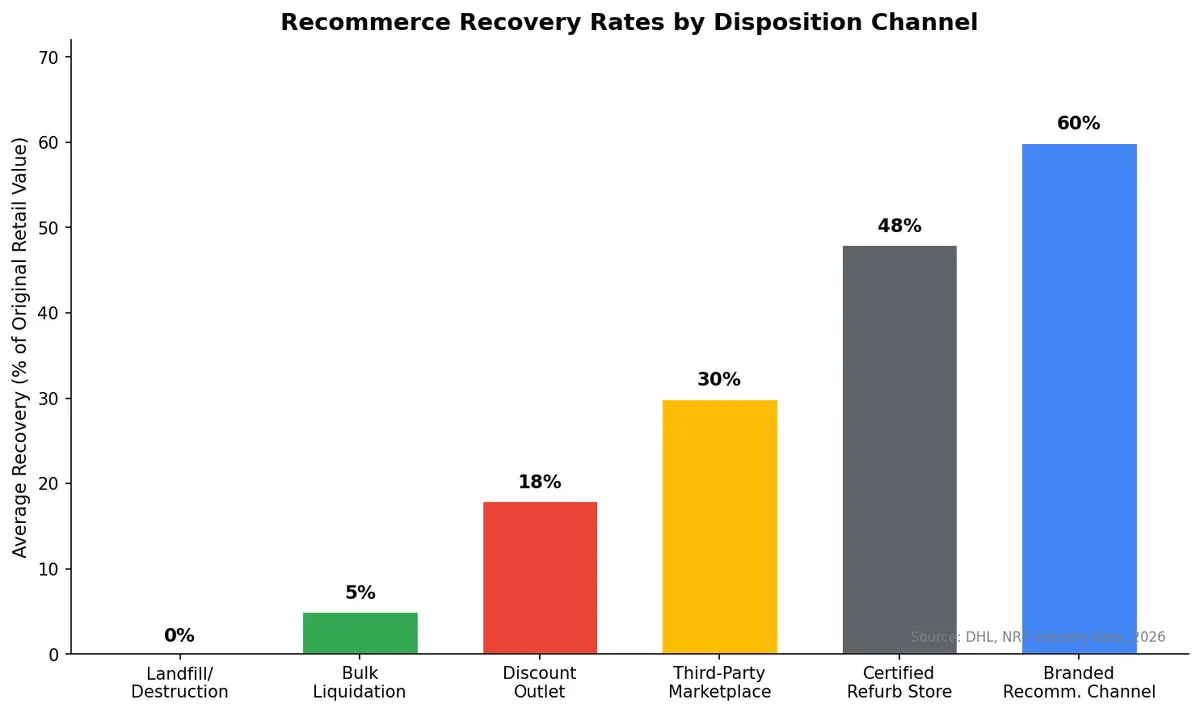

The recommerce movement has gone mainstream. According to industry data, 27% of retailers are prioritizing recommerce as part of their 2026 returns strategy. This isn't just reselling returned items — it's building an entire secondary supply chain.

What recommerce looks like at scale:

- Certified refurbishment programs that grade returned items (A/B/C condition) and resell through branded outlets

- Dynamic pricing engines that adjust resale prices in real time based on inventory levels and demand

- Cross-channel liquidation that routes unsellable returns to discount channels, donation programs, or material recyclers

- Integrated marketplaces where returned inventory feeds directly into secondary market platforms

The best operators recover 40–60% of original retail value on returned merchandise, compared to the industry average of just 15–25%. That gap represents billions in captured value.

Battlefront 3: Sustainability as Regulation

Sustainability in reverse logistics is no longer optional positioning — it's becoming regulatory reality. Extended Producer Responsibility (EPR) schemes are expanding globally, with 18% of logistics leaders citing EPR as a key driver for optimizing returns processing in 2026.

The EU's Ecodesign for Sustainable Products Regulation is pushing manufacturers to design for circularity, which directly impacts how returns flow through the reverse supply chain. Products must be easier to repair, refurbish, and recycle — and companies must prove it.

Smart shippers are getting ahead of this curve by:

- Tracking the environmental footprint of every return (carbon cost of shipping, processing, and disposition)

- Building circular return loops that minimize landfill waste

- Partnering with certified recyclers for items that can't be resold

- Publishing sustainability metrics on their returns operations

Companies that treat sustainability as a returns optimization lever — not just a compliance checkbox — find it reduces costs simultaneously. Fewer items going to landfill means more items generating revenue through recommerce channels.

The Technology Stack for Modern Returns

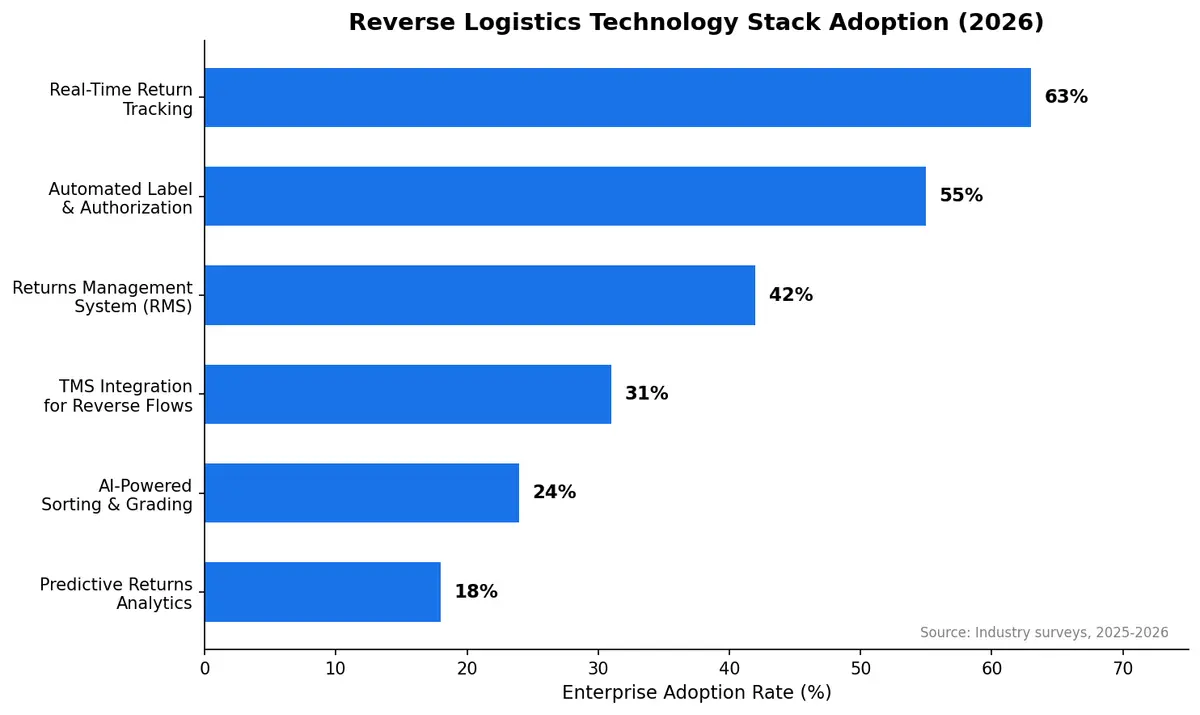

Winning the returns battlefield requires integrated technology, not bolt-on solutions. The modern reverse logistics stack includes:

Returns management systems (RMS) that automate authorization, label generation, and customer communication. The best platforms offer real-time return tracking that mirrors the outbound shipment experience.

AI-powered sorting and grading that uses computer vision to assess item condition and route it to the optimal disposition channel within seconds of arrival at a processing center.

Predictive returns analytics that forecast return volumes by SKU, season, and channel — enabling proactive staffing, inventory positioning, and markdown planning.

TMS integration for reverse flows that treats returns as shipments deserving the same optimization as outbound freight: carrier selection, route optimization, and consolidation.

The Integration Problem

Here's where most companies stumble: their forward and reverse supply chains run on completely different systems. Outbound orders flow through a polished TMS with real-time visibility. Returns flow through spreadsheets, email, and manual processes.

This disconnect creates blind spots. You can't optimize what you can't see. When reverse logistics data lives in silos, companies miss patterns — like a SKU with a 40% return rate that should trigger a product quality review, or a carrier whose return shipments take three times longer than competitors.

The fix isn't a standalone returns platform. It's integrating reverse logistics into the same TMS that handles your forward supply chain, giving you end-to-end visibility across every shipment direction.

Turning Returns Into Competitive Advantage

The companies treating returns as a strategic function — not a cost center — share common traits:

- They measure returns as a P&L line, not just a cost bucket

- They invest in speed, because disposition velocity directly correlates with value recovery

- They build recommerce channels, turning returned inventory into a revenue stream

- They integrate forward and reverse logistics into a single visibility platform

- They use returns data proactively to improve products, reduce future returns, and optimize inventory

The $850 billion returns problem isn't going away. But the companies that master reverse logistics will find that problem is actually an $850 billion opportunity hiding in plain sight.

Ready to integrate your forward and reverse logistics into a single platform? Contact CXTMS for a demo and see how unified TMS visibility transforms returns from a cost center into a competitive advantage.