Freight Payment Automation in 2026: How the Gartner Market Guide Is Redefining FAP Technology

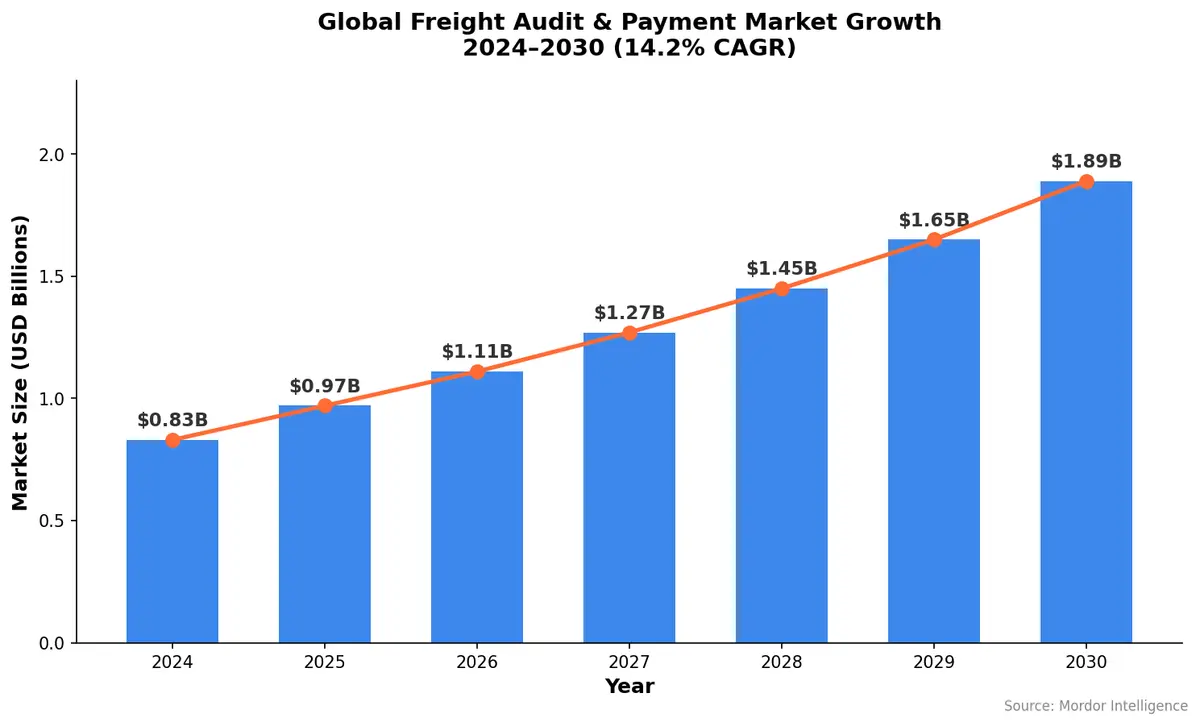

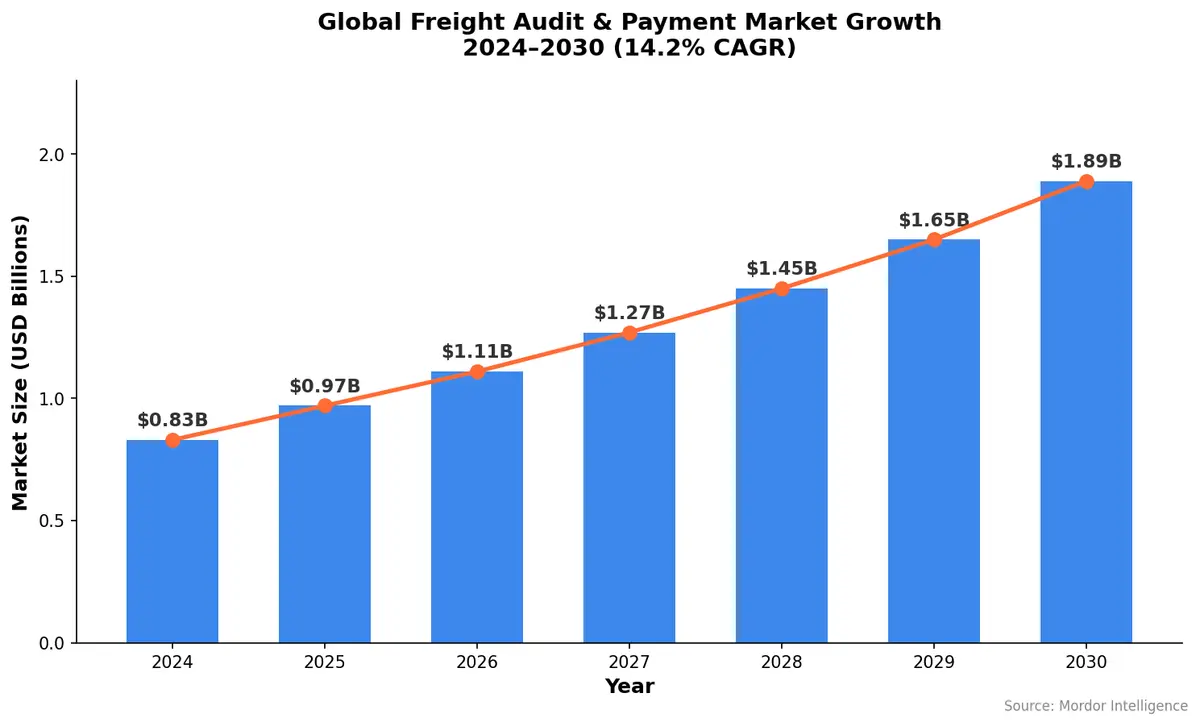

The freight audit and payment (FAP) market is no longer a back-office afterthought. With the global FAP market projected to reach $1.89 billion by 2030 at a 14.2% CAGR according to Mordor Intelligence, and the release of the 2026 Gartner Market Guide for Freight Audit and Payment Providers on February 10, the category is undergoing its most significant transformation in decades.

What the 2026 Gartner Market Guide Signals

Gartner's updated Market Guide — authored by Brian Day, Brian Whitlock, and Matthew Beckett — arrives at a pivotal moment. The guide recognizes that FAP providers are expanding far beyond traditional invoice auditing into freight procurement, global trade management, and supply chain orchestration, all powered by agentic AI.

The message is clear: organizations that still treat freight payment as a standalone cost center are falling behind. Modern FAP platforms now serve as strategic data hubs that connect sourcing decisions to payment execution in a single, automated workflow.

The guide highlights a growing demand for credible data insights to optimize logistics costs, with providers increasingly expected to deliver visibility into sustainability impacts alongside traditional spend analytics.

Payment Automation vs. Freight Audit: A Category Split

Historically, freight audit and freight payment were bundled together — you audited the invoice, then you paid it. In 2026, these functions are diverging into distinct technology categories with different requirements.

Traditional freight audit focuses on catching errors: duplicate invoices, incorrect accessorial charges, weight discrepancies, and rate misapplications. It's reactive by nature — find the problem after it happens, file the claim, recover the overcharge.

Payment automation, by contrast, is proactive. It encompasses the entire invoice lifecycle:

- Automated invoice ingestion across EDI, API, email, and portal scraping

- Real-time rate validation against contracted rates and tariff databases

- Multi-currency payment processing across carriers in 20+ languages and currencies

- GL coding and cost allocation that feeds directly into ERP systems

- Working capital optimization through strategic payment timing

As Logistics Management reports, the freight payment sector is entering "a new phase where AI is being paired with human expertise to improve audit accuracy, reduce fraud, and optimize transportation spend." U.S. Bank alone processes $43 billion in freight payments annually, underscoring the sheer scale of the opportunity.

Multi-Currency, Multi-Carrier Payment at Scale

Global shippers face a compounding complexity problem. A mid-size enterprise might work with 200+ carriers across 15 countries, each with different invoicing formats, payment terms, currencies, and regulatory requirements. Manual processing at this scale is not just inefficient — it's impossible to maintain accuracy.

Modern FAP platforms solve this through:

- Carrier network pre-integration — leading providers maintain connections to 100,000+ pre-onboarded carriers, eliminating months of onboarding friction

- Automated currency conversion with real-time exchange rate management

- Regional compliance engines that handle VAT, customs duties, and local tax requirements automatically

- Consolidated payment runs that batch thousands of carrier payments into optimized disbursement schedules

The result is measurable: organizations implementing automated freight payment typically see 3-5% recovery on total freight spend through better audit accuracy, and 60-70% reduction in invoice processing time compared to manual workflows.

Agentic AI: From Recommendations to Autonomous Execution

The most disruptive trend in the 2026 FAP landscape is the shift from AI that recommends actions to AI that executes them. This is the agentic AI revolution applied to freight finance.

Traditional AI in freight payment might flag a suspicious invoice for human review. Agentic AI goes further:

- Detects the anomaly — a carrier invoice shows an accessorial charge not in the contract

- Cross-references the contract — confirms the charge is unauthorized

- Initiates the dispute — files a claim with the carrier automatically

- Tracks resolution — monitors the carrier's response and escalates if needed

- Adjusts the payment — processes the corrected amount on schedule

Mike Regan, founding president of TranzAct, offers an important caveat: "People are buying the sizzle and ignoring the substance. Technology and AI are great, but so is experience and expertise." He notes that 30% of AI effectiveness is driven by prompt engineering, and another 30% relies on the human element — a reminder that the best FAP systems augment human judgment rather than replace it entirely.

Allan Miner, CEO of CT Logistics — now entering its second century of operations — echoes this balanced view: "We're embracing AI, but AI is only what you train it to do. We're training it to be a great freight auditor so we can employ those solutions in the marketplace."

What Shippers Should Evaluate in a FAP Provider

Given the Gartner Market Guide's expanded definition of FAP capabilities, here's what forward-thinking shippers should look for in 2026:

| Capability | Why It Matters |

|---|---|

| End-to-end automation | Source-to-pay workflow, not just audit-to-pay |

| Global multi-currency support | Essential for cross-border operations |

| Agentic AI capabilities | Autonomous exception handling reduces cycle time |

| ERP integration depth | GL coding and cost allocation must flow seamlessly |

| Carrier network breadth | Pre-onboarded carriers accelerate deployment |

| Sustainability analytics | Carbon impact visibility per shipment and carrier |

| Data analytics and benchmarking | Spend optimization requires comparative intelligence |

How CXTMS Streamlines Freight Payment Workflows

CXTMS approaches freight payment as an integrated component of transportation management — not a siloed afterthought. Our platform connects carrier rate management, shipment execution, and invoice processing in a unified workflow, ensuring that every payment is validated against the actual contracted rate and shipment details before disbursement.

With multi-currency support, automated GL coding, and real-time audit capabilities, CXTMS helps shippers reduce freight spend leakage while accelerating payment cycles from weeks to days.

Ready to modernize your freight payment operations? Contact CXTMS for a demo and see how integrated payment automation eliminates invoice errors and recovers hidden spend.