The Digital Supply Chain Tech Market Hits $72 Billion: A Buyer's Guide to the Platforms That Actually Deliver ROI

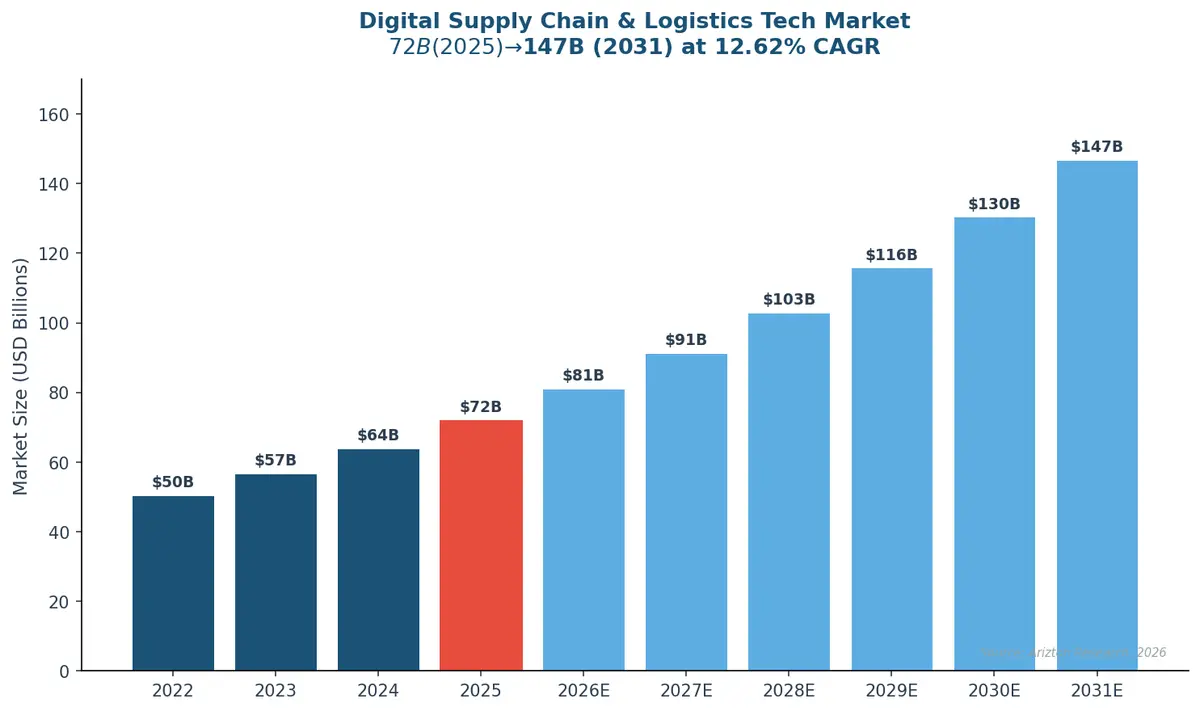

The digital supply chain and logistics technology market reached $72 billion in 2025 and is projected to hit $146.92 billion by 2031, growing at a 12.62% CAGR according to Arizton's latest research. That's nearly $75 billion in new spending headed into logistics tech over the next five years. The question isn't whether to invest — it's where to put your money so it actually comes back.

The Market Landscape: Where the $72 Billion Is Going

The supply chain software market has fragmented into dozens of overlapping categories, each with its own army of vendors promising transformation. But when you strip away the marketing, the spending falls into five major buckets:

Transportation Management Systems (TMS) remain the backbone of freight operations, handling carrier selection, rate management, shipment execution, and freight audit. Gartner reports that companies achieving effective TMS and WMS integration see 5–10% savings on freight costs — a figure that compounds quickly at enterprise scale.

Warehouse Management Systems (WMS) have evolved from inventory tracking tools into full execution platforms managing labor, robotics, and real-time workload balancing. Intraday planning capabilities — adjusting labor allocation mid-shift based on real-time conditions — are now a top evaluation criterion for buyers.

Supply chain visibility platforms provide real-time tracking and exception management across modes and geographies. The challenge here is that most visibility tools still operate as point solutions, offering tracking without actionable intelligence.

Procurement and sourcing platforms are increasingly powered by agentic AI that autonomously manages RFPs, evaluates supplier responses, and monitors risk in real time.

Analytics and planning tools round out the landscape, with digital twins and simulation capabilities gaining traction for scenario planning and disruption response.

Agentic AI: The Shift From Insights to Autonomous Execution

The biggest technology shift reshaping this market isn't another dashboard — it's the rise of agentic AI. According to KPMG's 2026 supply chain trends report, AI agents are now operating across existing source-to-pay, contract lifecycle management, and third-party risk systems. These agents are autonomously issuing and managing RFPs, evaluating supplier responses, triggering onboarding processes, monitoring supplier risk, and identifying upcoming contract renewals — all without human intervention for routine decisions.

Gartner projects that by 2028, at least 15% of day-to-day work decisions will be made autonomously through agentic AI. That's not a pilot program statistic — it's a fundamental shift in how supply chain operations run.

But here's the critical distinction for buyers: most AI implementations today are still narrow and tied to individual functions. As Capgemini's research shows, just 17% of global supply chains can respond to disruptions within 24 hours, and even those top performers average five full days for complete recovery. The software that wins in 2026 isn't the one with the most AI features — it's the one that connects AI across planning and execution to compress that response timeline.

The Buyer's Evaluation Framework: Cutting Through the Hype

With hundreds of vendors competing for a slice of $72 billion, evaluation fatigue is real. Here's a framework that separates the platforms delivering ROI from the ones delivering demos:

1. Integration Over Innovation

The most common failure in supply chain tech isn't picking the wrong tool — it's picking a tool that doesn't talk to your existing systems. Siloed ERP, TMS, and WMS platforms remain the single biggest barrier to ROI, according to McKinsey's research on self-aware supply chains. Before evaluating features, map your integration requirements. A platform that connects your existing stack delivers more value than a revolutionary tool that operates in isolation.

2. Time-to-Value Over Feature Count

Enterprise supply chain implementations historically take 12–18 months. In a market moving at 12.6% annual growth, that timeline is a liability. Evaluate vendors on their implementation track record, not their feature roadmap. Ask for reference customers who achieved measurable ROI within six months.

3. Disruption Response Speed as a Benchmark

With 57% of industries requiring up to six months to recover from a one-week transportation disruption, your platform's ability to detect, alert, and enable action in real time is no longer a nice-to-have. Test this capability during evaluation — simulate a disruption scenario and measure how quickly the platform surfaces actionable options.

4. Composability Over Suite Lock-In

The era of monolithic supply chain suites is ending. Leading organizations are building composable technology stacks — selecting best-of-breed solutions for specific functions and connecting them through APIs and middleware. Look for platforms that play well with others rather than demanding you replace everything.

5. Human Oversight Built Into AI Workflows

As agentic AI takes on more autonomous decisions, the platforms that will survive regulatory scrutiny and earn operational trust are the ones that build clear escalation paths, audit trails, and human override capabilities into every automated workflow.

Category-by-Category: What to Prioritize

If you're shipping freight: Start with TMS. It's the highest-ROI investment for most shippers, with measurable savings in carrier spend, audit recovery, and operational efficiency within months. Look for platforms that combine rate management, carrier selection, and visibility in a single workflow.

If you're running warehouses: WMS with real-time labor management and intraday planning is the priority. The ability to dynamically rebalance work across zones during a shift — not after it — is the differentiator in 2026.

If you're managing global supply chains: Visibility and risk platforms are essential, but only if they connect to your execution systems. Visibility without action is just expensive watching.

If you're in procurement: Agentic AI capabilities in source-to-pay are delivering immediate ROI by automating routine sourcing decisions while escalating complex negotiations to humans.

Where CXTMS Fits: The Integrated Platform Approach

The market data points to a clear conclusion: fragmented point solutions create more problems than they solve. The organizations seeing the strongest ROI are those consolidating onto integrated platforms that connect transportation, warehousing, visibility, and analytics into a unified workflow.

CXTMS was built on this principle. Rather than bolting together disconnected modules, CXTMS provides a single platform where shipment execution, carrier management, real-time visibility, and analytics share a common data layer. That means when a disruption hits, the system doesn't just alert you — it shows you the alternatives, the cost implications, and the downstream impacts across your entire operation.

In a $72 billion market that's doubling in six years, the winners won't be the companies that buy the most technology. They'll be the ones that buy the right technology — platforms that integrate deeply, implement quickly, and deliver measurable returns before the next budget cycle.

Ready to see how an integrated TMS platform delivers ROI in weeks, not years? Contact CXTMS for a personalized demo.