AI Load Optimization Is Increasing Truck Utilization by 16%: Why Empty Miles Are Becoming Extinct

The American trucking industry has an expensive secret: between 20% and 35% of all truck miles driven are completely empty. Loaded trucks, meanwhile, operate at just 57% capacity utilization on average. In an industry where fuel, labor, and equipment costs climb every quarter, shipping air is a luxury nobody can afford — and AI is finally making it unnecessary.

The True Cost of Empty Miles

Every empty mile is money burning on the highway. A truck averaging 100,000 miles per year with a 20% empty rate wastes 20,000 miles of fuel, maintenance, and driver time. Across the U.S. trucking fleet, this inefficiency adds up to billions of dollars in annual waste and millions of tons of unnecessary carbon emissions.

The root cause isn't laziness — it's complexity. Matching available trucks with freight heading the right direction, at the right time, with compatible cargo requirements has historically been a manual process. Dispatchers work phones, check load boards, and make educated guesses. By the time they find a backhaul, the truck is already rolling empty.

How AI Changes the Equation

Artificial intelligence attacks the empty miles problem from multiple angles simultaneously, processing thousands of variables that no human dispatcher could evaluate in real time.

Intelligent Freight Matching

AI-powered platforms analyze historical lane data, shipper schedules, seasonal patterns, and real-time GPS positions to predict where trucks will be — and what freight will need moving — before either party knows it. According to Gitnux's 2026 AI logistics report, Roland Berger found that AI load optimization increases capacity utilization by 16%, a game-changing improvement in an industry where single-digit margin gains determine survival.

Coordinated Freight Networks

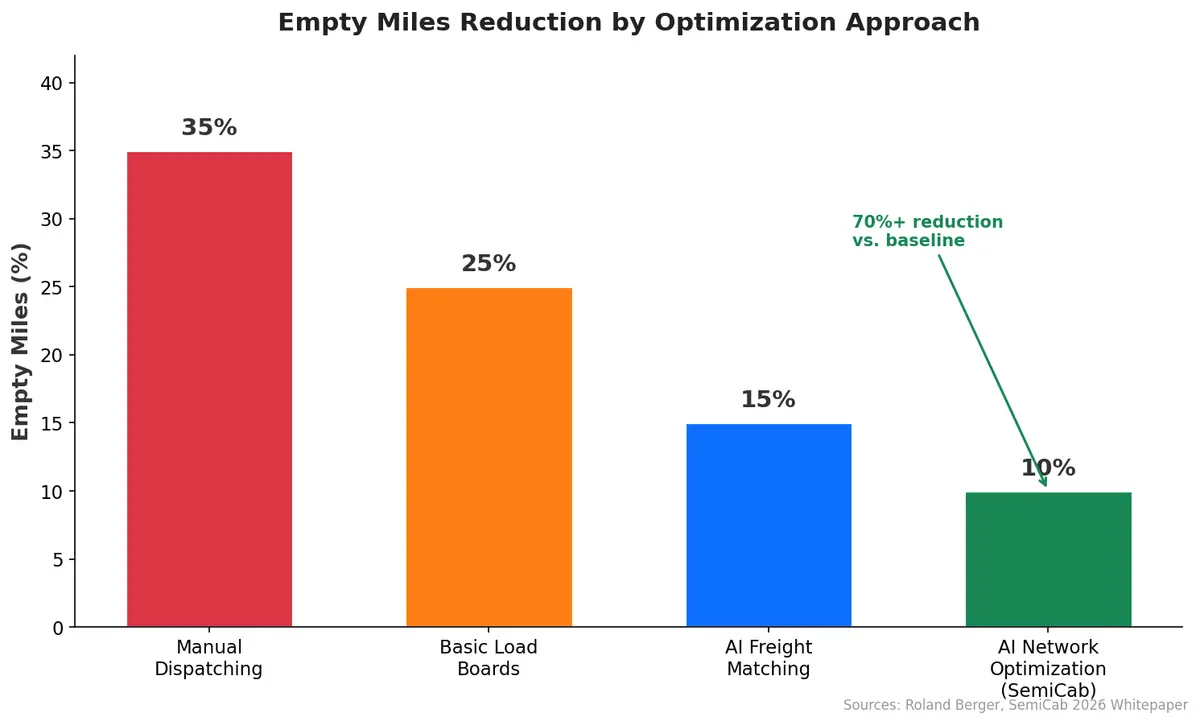

The most dramatic results come from network-level optimization. In February 2026, the SemiCab platform published a whitepaper demonstrating more than 70% reduction in empty freight miles across its active customer networks. Rather than optimizing individual shipments, the platform coordinates freight across multiple shippers to create continuous-move loops where trucks rarely deadhead.

This network approach represents a fundamental shift from isolated transactions to collaborative freight ecosystems. When shippers share lane data within a secure platform, AI can construct relay routes that keep trucks loaded across their entire journey — not just the primary haul.

3D Load Planning

Beyond matching trucks to freight, AI is optimizing what goes inside the trailer. Modern 3D load planning algorithms consider cargo dimensions, weight distribution, stacking rules, and unloading sequence to maximize cubic utilization. These systems can increase trailer density by 12–18% compared to manual planning, meaning fewer trucks needed for the same freight volume.

Weight distribution optimization also improves safety and fuel efficiency. Properly balanced loads reduce tire wear, improve braking performance, and can save 3–5% on fuel consumption per trip.

The Market Is Tightening — Efficiency Is Non-Negotiable

The timing couldn't be more critical. C.H. Robinson's January 2026 freight market update projects approximately 8% year-over-year truckload rate growth in 2026, revised upward from an earlier 6% forecast. As rates climb, shippers face intense pressure to move the same volume with fewer loads.

Meanwhile, Supply Chain Dive's 2026 logistics outlook highlights operational volatility as a defining theme of the year. Carriers that survived the 2023–2024 freight recession are now operating leaner — they simply cannot absorb empty-mile costs the way they once did.

From Route Optimization to Autonomous Decision-Making

AI load optimization is evolving beyond simple matching algorithms. The latest generation of platforms incorporates:

- Predictive demand modeling that forecasts freight volumes 48–72 hours ahead, giving carriers time to position equipment proactively

- Dynamic pricing engines that adjust rates in real time based on lane utilization, helping balance supply and demand across the network

- Multi-modal optimization that automatically evaluates whether a shipment should move by truck, rail, or intermodal based on cost, transit time, and carbon footprint

- Weather and disruption routing that reroutes loads around congestion, storms, or infrastructure closures before delays occur

Companies implementing these capabilities are reporting 10–45% reductions in empty miles depending on their starting point and the depth of their AI integration.

What This Means for Shippers and Carriers

For shippers, AI load optimization translates directly to lower transportation costs and improved sustainability metrics. Fewer trucks carrying the same freight means lower per-unit shipping costs and reduced Scope 3 emissions — an increasingly important factor for ESG reporting.

For carriers, higher utilization means better revenue per truck per day, the single most important metric in trucking profitability. A 16% improvement in capacity utilization can be the difference between operating at a loss and running a profitable fleet.

The technology also reshapes shipper-carrier relationships. When AI platforms demonstrate consistent backhaul opportunities, carriers offer better rates on primary lanes — creating a virtuous cycle of optimization and cost reduction.

Building Load Intelligence Into Your TMS

The most effective load optimization doesn't exist in isolation. It requires deep integration with transportation management systems that handle order management, carrier procurement, and execution in a unified workflow. CXTMS connects load optimization intelligence with real-time carrier availability, rate management, and shipment execution — ensuring that optimized loads actually move on schedule, not just on paper.

Empty miles aren't just a cost problem — they're a competitiveness problem. Contact CXTMS to see how intelligent load optimization can transform your freight economics.