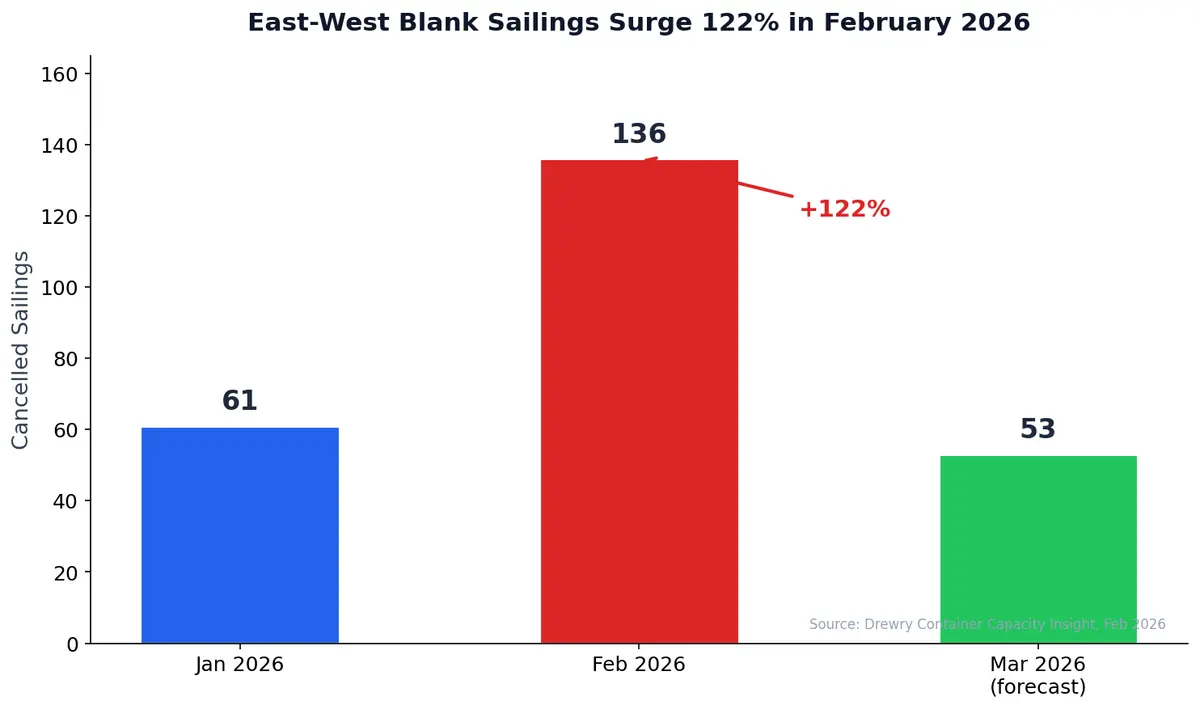

Blank Sailings Hit 122% Surge in February 2026: How Shippers Should Navigate the Transpacific Capacity Squeeze

February 2026 has delivered a wake-up call to ocean shippers worldwide. According to Drewry's Container Capacity Insight, 136 scheduled sailings across transpacific, Asia-Europe/Mediterranean, and transatlantic routes have been cancelled this month — a staggering 122% increase compared to January. For shippers relying on predictable ocean freight schedules, this surge in blank sailings is reshaping booking strategies in real time.

What's Driving the Blank Sailing Surge?

The numbers are hard to ignore. Drewry's cancelled sailings tracker shows that 18% of all planned departures over a five-week window from early February to mid-March have been blanked — roughly 125 out of 710 scheduled sailings. The transpacific trade lane has been hit hardest.

Several forces are converging to create this wave of cancellations:

Post-Lunar New Year demand collapse. Chinese New Year, which began February 17 this year, triggered the predictable seasonal slowdown in Asian exports. But 2026's demand drop has been sharper than expected, with cargo volumes falling off a cliff as factories shuttered and export orders thinned out.

Spot rates below carrier comfort zones. The Drewry World Container Index fell 10% to $2,212 per FEU in mid-February, marking the second consecutive week of double-digit declines. Shanghai-to-Los Angeles rates dropped 12% to $2,546 per FEU, while Shanghai-to-New York slid 11% to $3,191 per FEU. With rates trending toward break-even territory, carriers have pulled the blank sailing lever aggressively to arrest the slide.

Suez Canal uncertainty. As major carriers like Maersk begin testing return routes through the Suez Canal, the market faces a dual dynamic — potential capacity flooding from shorter transit times combined with lingering Red Sea security risks. CMA CGM notably reversed course on three Asia-Europe services, re-routing them around Africa without explanation.

The Real Impact on Shippers

While Drewry maintains that effective ship capacity won't be cut overall between Q4 2025 and Q1 2026, the operational reality for individual shippers is far less reassuring.

Booking reliability has cratered. When nearly one in five scheduled sailings disappears, shippers face rolling delays, missed connections, and scrambled inland logistics. A container booked three weeks out may simply not have a vessel to board.

Transit time variability is spiking. Even when sailings operate, the knock-on effects of blanked services create port congestion, chassis shortages, and dwell time increases. San Pedro Bay container dwell times spiked in February as vessel calls collapsed ahead of Lunar New Year, according to industry reporting.

Port frequency is declining. Less frequent sailings from many origin ports means shippers at secondary Asian ports face longer wait times between available services, making just-in-time inventory strategies increasingly risky.

A Silver Lining: March Relief Is Coming

The data does offer some reassurance. Drewry forecasts blank sailings will drop to approximately 53 cancellations in March on major East-West routes, with effective capacity expanding by 20% or more month-on-month. The February surge appears to be a concentrated seasonal adjustment rather than a structural capacity crisis.

But shippers who wait passively for the market to normalize risk getting caught in the transition period between February's tight conditions and March's capacity recovery.

Tactical Playbook for Navigating Blank Sailings

Smart shippers are already adapting. Here's what leading supply chain teams are doing right now:

1. Split-Route Your Transpacific Bookings

Don't concentrate all volume on a single carrier or alliance. Splitting bookings across multiple carriers — and across both West Coast and East Coast gateway ports — provides natural hedging against blank sailings on any single service string.

2. Build Flexible Booking Windows

Move away from fixed sailing date commitments. Negotiate booking windows of 3-5 days rather than specific vessel assignments. This gives carriers flexibility to consolidate loads while giving shippers assurance of movement within an acceptable timeframe.

3. Monitor Carrier Blank Sailing Announcements in Real Time

Carriers typically announce blanked sailings 2-4 weeks before departure. Shippers with real-time visibility into carrier schedule changes can pivot booking strategies before capacity evaporates. Manual tracking via carrier websites is no longer sufficient at this scale.

4. Leverage Contract Diversification

Shippers locked into single-carrier contracts face the most disruption during blank sailing surges. Consider maintaining spot market access for 20-30% of volume as a pressure valve when contracted capacity disappears.

5. Accelerate Inland Logistics Planning

When a vessel arrives after a blank sailing delay, port terminals face surge volumes. Pre-arrange drayage, warehouse receiving appointments, and inland transportation to avoid compounding delays at the port.

How TMS Visibility Turns Blank Sailings from Crisis to Manageable Disruption

The difference between shippers who weather blank sailing storms and those who suffer cascading delays comes down to visibility and agility. Modern TMS platforms that integrate carrier schedule data, track blank sailing announcements, and provide automated rebooking workflows transform what was once a frantic phone-call scramble into a structured exception management process.

CXTMS ocean visibility tools aggregate carrier schedule changes across alliances, flag at-risk bookings before sailings are officially blanked, and recommend alternative routing — giving logistics teams the lead time they need to protect their supply chains.

Looking Ahead: Q1 2026 and Beyond

The blank sailing surge of February 2026 is a symptom of a broader market reality: overcapacity meets weak demand. With global container fleet growth outpacing trade volume increases and Suez Canal routes gradually reopening, carriers will continue using blank sailings as their primary rate management tool throughout 2026.

Shippers who build blank sailing resilience into their ocean freight programs now — through diversified routing, real-time visibility, and flexible booking strategies — will be better positioned regardless of how aggressively carriers manage capacity in the months ahead.

Navigating blank sailings and transpacific disruption? Contact CXTMS for a demo of our ocean visibility and booking management platform.